How Trade and Debt Contribute to Global Tensions

How Trade and Debt Contribute to Global Tensions

We are all aware of the geopolitical tensions that exist. They also affect our printer and imaging supplies industry.

We are all aware of the geopolitical tensions that exist. They also affect our printer and imaging supplies industry.

Most people reading this article now know that the Ninestar ban in the USA has much more to do with geopolitics between the USA and China than anything Ninestar has actually done wrong. I guess the truth on that score will eventually come out.

Trade has historically been a significant source of tension between countries, driven by various economic, political, and strategic factors. One primary reason for this tension is the competition for resources.

Essential resources such as gold, spices, and, more recently, oil and rare minerals are key resources that are fought over. In the colonial expeditions to Asia, Africa, and the Americas, European powers competed fiercely to dominate trade routes and resource-rich territories.

Another factor contributing to trade-related tensions is the imbalance of trade benefits. When one country benefits disproportionately from trade, it can lead to economic disparities and resentment. This is also evident in the struggle for dominance between China and the USA.

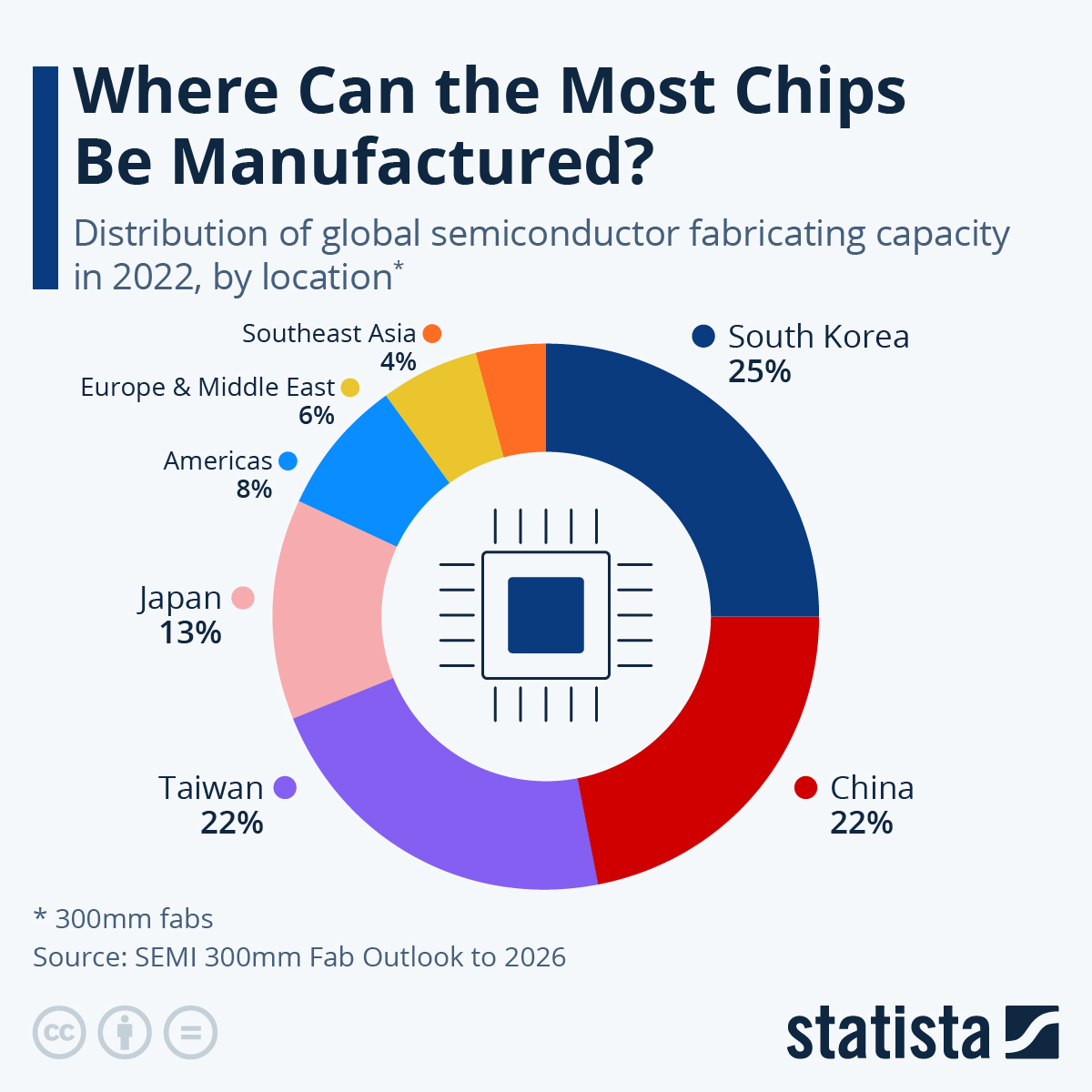

The manufacturing of chips comes to mind.

According to data from the semiconductor lobby organization SEMI, about 70 per cent of total manufacturing capacity lies in South Korea, Taiwan, and China. The Americas rank fifth after Japan, which boasted a 13 percent share in 2022. (credit to Statista for the chart)

According to data from the semiconductor lobby organization SEMI, about 70 per cent of total manufacturing capacity lies in South Korea, Taiwan, and China. The Americas rank fifth after Japan, which boasted a 13 percent share in 2022. (credit to Statista for the chart)

It was very different a couple of decades ago, with the United States covering 37 percent of fabrication capacity in 1990, Europe a further 44 percent and Japan came in third at 19 percent.

To reclaim at least parts of its former manufacturing dominance, the Biden administration passed the CHIPS and Science Act in August 2022, allocating around $280 billion to push the lagging domestic chips industry in terms of research and production. Whether this measure is enough for the United States to squeeze past China, its biggest economic competitor, remains to be seen.

The US trade deficit with China also impacts our industry

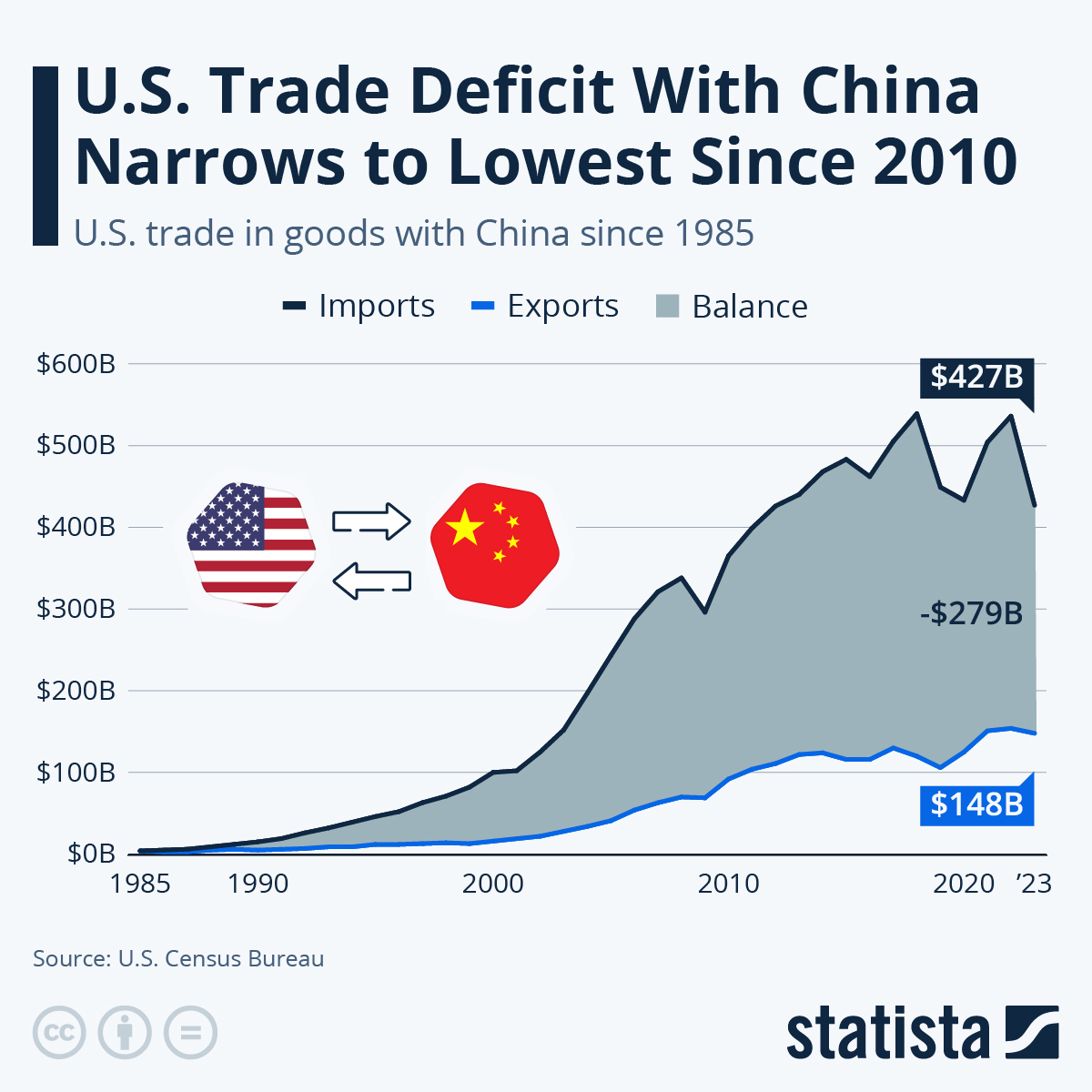

Americans will be pleased to learn the U.S. trade deficit in goods trade with China narrowed to its lowest level since 2010 last year, as imports from China fell by more than $100 billion compared to the previous year (credit to Statista for the chart).

Americans will be pleased to learn the U.S. trade deficit in goods trade with China narrowed to its lowest level since 2010 last year, as imports from China fell by more than $100 billion compared to the previous year (credit to Statista for the chart).

According to the U.S. Census Bureau, the deficit with China decreased more than 25 percent to $279 billion in 2023 as tensions between the two superpowers remained high.

However, Chinese platforms like Temu, which are shipping increasingly large quantities of packages directly to U.S. consumers, including printer cartridges, take advantage of the loophole that allows packages worth less than $800 to enter the U.S. tariff-free. These shipments aren’t counted in U.S. trade data, meaning that actual imports from China are higher than official data suggests.

Also, as China continues to capture traditional US trade markets in Africa, Asia Pacific, Europe and Latin America, we can expect tensions to increase, sanctions to be imposed, and tariffs and taxes to increase. The two largest economies in the world are destined to bump heads much more.

Related:

- Imports vs Exports – Why the US Wars with China

- China Beats USA in Race for Automated Production Lines

- Ninestar – the Chinese matter that won’t go away

Comment:

Please add your comments below about this article, “How Trade and Debt Contribute to Global Tensions.”

David Gibbons has 47 years of experience, knowledge and skills in business (management, consultancy, strategic planning) and communication (teaching, event management, fundraising, journalism, broadcasting and new/digital media—social, website, app development). He started and ran a successful cartridge remanufacturing business in Sydney and was also the Executive Officer of the Australasian Cartridge Remanufacturers’ Association for 7 years.

David Gibbons has 47 years of experience, knowledge and skills in business (management, consultancy, strategic planning) and communication (teaching, event management, fundraising, journalism, broadcasting and new/digital media—social, website, app development). He started and ran a successful cartridge remanufacturing business in Sydney and was also the Executive Officer of the Australasian Cartridge Remanufacturers’ Association for 7 years.

In 2011, Gibbons relocated to RT Media in Zhuhai, China where he has been a director responsible for strategic planning, senior management, event planning, marketing, broadcasting and magazine publishing on behalf of the global imaging supplies industry. He is certainly aware of the challenges of remanufacturing in China.

His other blogs include:

- Some Quick Ink Facts I Bet You Never Knew

- Anger Over Exaggerations Lies and Deceit

- Invention—”Doing Our Part in Order to Create a Better Future”

- Einstein: Discovering the Impossible

- The Challenges of Remanufacturing in China

- Can the Chinese Really Deliver What the Rest of Us Want?

- Using Chip Technology to Control Consumer Choice and Markets

- 5 Quick Questions: Investing in Your Supply Chain

- A Misplaced Australian in China – a different world view

- What the Dickens? Americans used to abuse IP rights too.

Leave a Comment

Want to join the discussion?Feel free to contribute!