InkTank Printers Boom Despite Indian Market Decline

InkTank Printers Boom Despite Indian Market Decline

The Indian market, which is celebrating the Diwali festival season with improving consumer sentiment, witnessed a growth of 164.8% in hard copy peripheral (HCPs), or 910,000 printers sold, during Q3 2020 (July-September) compared with the same period last year.

The Indian market, which is celebrating the Diwali festival season with improving consumer sentiment, witnessed a growth of 164.8% in hard copy peripheral (HCPs), or 910,000 printers sold, during Q3 2020 (July-September) compared with the same period last year.

However, according to the latest IDC Worldwide Quarterly Hardcopy Peripherals Tracker, when you compare the figures year-on-year (YoY), there was a decline of 12.7%.

In the inkjet segment, vendors continued to face supply issues throughout the quarter as their manufacturing hubs in China and Southeast Asian countries grappled with the unprecedented global surge in demand for inkjet printers from the Home segment. Due to the supply issues, the ink tank segment noted a YoY decline of 6.9%, yet it continued to increase its share over the ink cartridge segment from the same time a year ago.

The laser segment (including the copier segment) suffered an even sharper YoY decline of 17.3% following the drop in demand from the commercial segment The situation improved significantly from Q2 2020 as the lockdown eased with some corporates and SMBs resuming office operations with a limited workforce while a majority continued operating on work-from-home mode. For similar reasons, the laser copier segment too witnessed a YoY decline of 36.8% to date.

“As lockdown restrictions gradually eased, consumer demand saw significant growth within the HCP market. Demand for Wi-Fi and multi-function ink tank categories rebounded significantly. Within the overall inkjet segment, ink cartridge-based printers also saw healthy demand from smaller cities as a section of consumers did not want to pay the premium for ink tank printers. In laser printer segment, government procurement resumed to some extent, whereas, enterprise and jobber demand continued to remain muted owing to the closure of schools and offices,” says Bani Johri, Market Analyst, IPDS, IDC India.

Top 3 Brand Highlights:

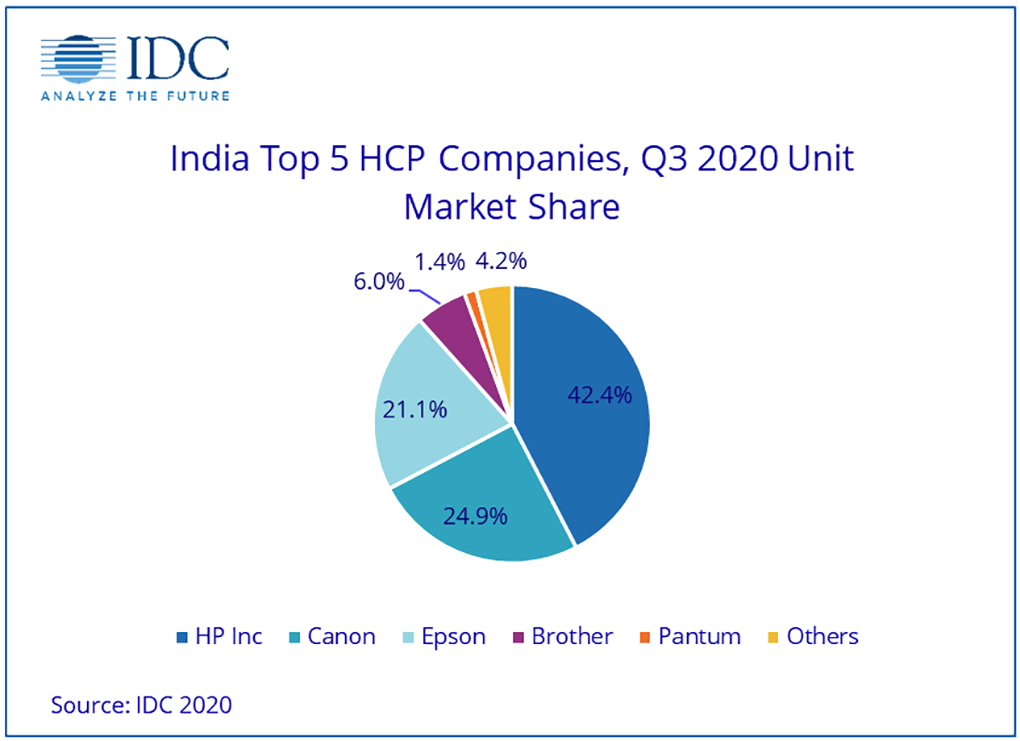

HP Inc. (excluding Samsung) maintained its leadership in the overall HCP market with a share of 42.4% despite a marginal decline in shipment by 0.3% YoY. It faced significant supply issues at the beginning of the quarter as its manufacturing units are largely based out of China. The situation improved for the company towards the end of the quarter, which helped their inkjet segment grow by 18.9% YoY. While the laser printer segment declined by 14.4% YoY. HP retained its 1st position in the inkjet segment after 3 years as it captured a market share of 37.4% owing to its strong volume in ink cartridge-based printers. On the laser printer front (excluding laser copiers), HP continued to maintain its number #1 position with a 57.8% market share.

Canon recorded a YoY decline of 6.3% while replacing Epson for the 2nd position in the India HCP market, capturing a 24.9% unit market share. In the inkjet segment, Canon maintained the same shipments as Q3 2019. In the laser segment (including laser copiers) Canon dropped back to 2nd position with a market share of 21.7%. In the laser copier segment, although Canon declined by 35.1% YoY, yet it continues to lead the copier market with a 29.7% unit market share because of its wide product portfolio and a strong foothold in the corporate segment.

Epson lost its 2nd position in the overall HCP market to Canon and was ranked third during Q3 2020 with a market share of 21.1% registering a decline in shipment by 28.5% YoY. Epson faced more severe supply issues compared to HP and Canon, which contributed significantly to the company’s decline in market share. Epson noted a market share of 32.3% in the inkjet segment, losing out some market share in the ink cartridge models segment to HP and Canon, which were preferred by a section of home users reluctant to make a high investment in ink tank printers.

IDC India Market Outlook:

“The recovery seen in ink tank printers in Q3 2020 is expected to continue in Q4 2020 with festive buying in the fourth quarter. While the overall HCP market shall remain challenged in 2020, demand is expected to be normalized across both inkjet and laser printers by 1H21 as supply issues for the vendors ease gradually. Demand from SMBs and jobbers is critical to sustaining the momentum in the longer-term market recovery as the pent up consumer demand may ease in the next few quarters,” says Nishant Bansal, Senior Research Manager, IPDS, IDC India.

Related:

- IDC: Hardcopy Printer Shipment Segment Grows 8.6%

$6 Million of Fake HP Cartridges Seized in India - Pantum Launches New Models in India

- Indian Aftermarket Reacts to Border Clashes with China

- IDC: India HCP Market Takes a Dive

- Is India Ready to Cut Imports and Develop Manufacturing?

- India Adds Taxes to Toners from China Malaysia and Taiwan

Comment:

Please add your comments below about this news story, “InkTank Printers Boom Despite Indian Market Decline.”

Leave a Comment

Want to join the discussion?Feel free to contribute!