22.5% Decline in Printer Sales Blamed on Supply Chain

22.5% Decline in Printer Sales Blamed on Supply Chain Disruption

According to market intelligence provider, International Data Corporation (IDC), the number of shipments of printing devices in India has slumped 22.5% compared with the same time last year.

According to market intelligence provider, International Data Corporation (IDC), the number of shipments of printing devices in India has slumped 22.5% compared with the same time last year.

With China having been closed to manufacturing due to COVID-19 for most of February and March, printer OEMs have been scrambling to meet demand. Most printer OEMs manufacture their printers in China. This was further accentuated by the countrywide lockdown in India from March 24, 2020.

The hard copy peripherals (HCP) market in India registered shipments of 0.66 million units in CY 1Q20, with a decline of 22.5% year-over-year (YoY), according to the latest IDC Worldwide Quarterly Hardcopy Peripherals Tracker, 1Q20. Following the disruption in supply chain and demand shock due to COVID-19, the HCP industry observed the sharpest quarter-over-quarter (QoQ) decline of 16.5%, to date.

This resulted in a sharp YoY decline in the inkjet and laser segment (including the copier segment) by 22.4% and 22.6%, respectively. Moreover, many orders, which were supposed to be executed in the 2nd half of March, could not be delivered to channel leading to reverse invoicing in a few cases.

“Laser Copier segment witnessed maximum impact, declining by 48.7% YoY,” said Bani Johri (pictured), Market Analyst, IPDS, IDC India. “To sever supply challenges, many orders remain unbilled since most of the orders in this segment are typically executed in the second half of March.”

“Laser Copier segment witnessed maximum impact, declining by 48.7% YoY,” said Bani Johri (pictured), Market Analyst, IPDS, IDC India. “To sever supply challenges, many orders remain unbilled since most of the orders in this segment are typically executed in the second half of March.”

Johri explained that Q1 typically sees strong demand from the government which was impacted majorly, leading to multiple orders being either put on hold or cancelled. She added, “While the overall inkjet market declined, the ink tank segment gained market share by 4.5% YoY. SOHOs and consumer segment particularly continue to swiftly adopt ink tank over ink cartridge-based models.”

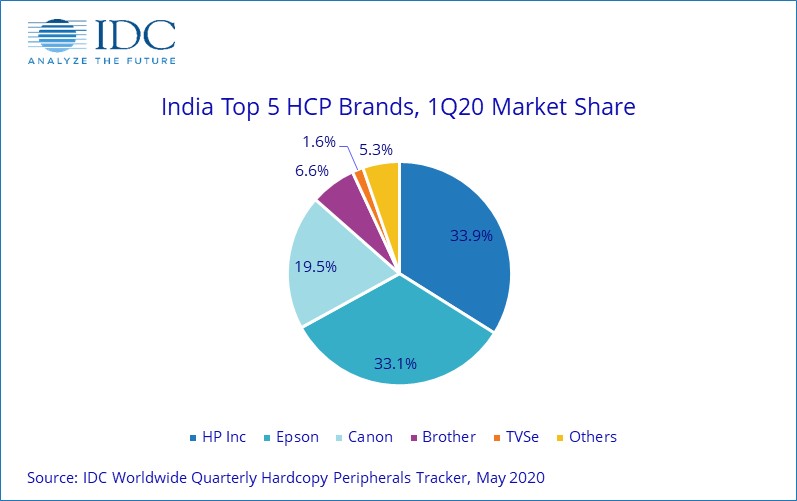

Top 3 Brand Highlights:

HP Inc. (excluding Samsung) maintained its leadership in HCP with a market share of 33.9% while its shipment declined by 30.0% YoY. It faced severe supply issues as its manufacturing units are based in China. While the Laser Printer segment declined by 20.5% YoY, the inkjet segment declined by 46.5% YoY. HP dropped to the 3rd position in the Inkjet segment owing primarily because of its supply issues. On the Laser printer front, HP continued to maintain its number 1 position with a 61.0% market share.

Epson maintained its 2nd position in the overall HCP market with a market share of 33.1%. Like other vendors, Epson was also forced to close its books early in March which to a decline in shipment by 17.8% YoY. Apart from a couple of models, Epson did not face severe supply issues. It also strengthened its leadership position in the inkjet segment by registering its highest unit market share of 60.4%, to date.

Canon recorded a YoY decline of 5.8% while maintaining its 3rd position in the HCP market and capturing a 19.5% market share. In the inkjet segment, while Canon declined YoY by 8.5% as a result of supply issues, it played a key role in increasing the market share of the overall ink tank segment. In the Laser Copier segment, although Canon declined by 37.2% YoY, yet it continues to lead the copier market with 29.3% market share as a result of its wide product portfolio and a strong foothold in the corporate segment.

IDC India Market Outlook:

According to Nishant Bansal (pictured), Senior Research Manager, IPDS, IDC India, there is a lot of uncertainty resulting in frequent changes to the outlook for the coming quarters due to COVID-19 pandemic resulting in multiple tranches of nationwide lockdown. “Under the assumption that things become normal from 3Q20 onwards,” he said, “vendors are still likely to face a slowdown in consumer demand as they prioritize their spending towards essential goods.”

According to Nishant Bansal (pictured), Senior Research Manager, IPDS, IDC India, there is a lot of uncertainty resulting in frequent changes to the outlook for the coming quarters due to COVID-19 pandemic resulting in multiple tranches of nationwide lockdown. “Under the assumption that things become normal from 3Q20 onwards,” he said, “vendors are still likely to face a slowdown in consumer demand as they prioritize their spending towards essential goods.”

Despite weakness in consumer demand, IDC expects the India HCP market will start showing signs of recovery from 3Q20 onwards as economic growth starts rebounding. “Vendors are likely to become aggressive with their marketing and promotional campaigns during 4Q20 to cash in on the festive season,” Bansal added.

IDC also expects brands to make a significant push towards online sales as the fears around COVID-19 are likely to play on consumer’s minds while considering a visit to retail stores. Commercial printing demand is also likely to witness a slowdown in the aftermath of lockdown as organizations might look to continue with remote working post lockdown as well.”

Related:

- IDC Predicts Print Service Growth Through 2023

- IDC: Worldwide HCP Market Reports Value Growth in Q4 2019

- IDC: Western European Printer Market Reports Less than Expected

Comment:

What do you think of this story, “22.5% Decline in Printer Sales Blamed on Supply Chain”? Please add your comments below.

Leave a Comment

Want to join the discussion?Feel free to contribute!