Quocirca Snapshot Survey Reveals Office Print Changes

Quocirca Snapshot Survey Reveals Office Print Changes

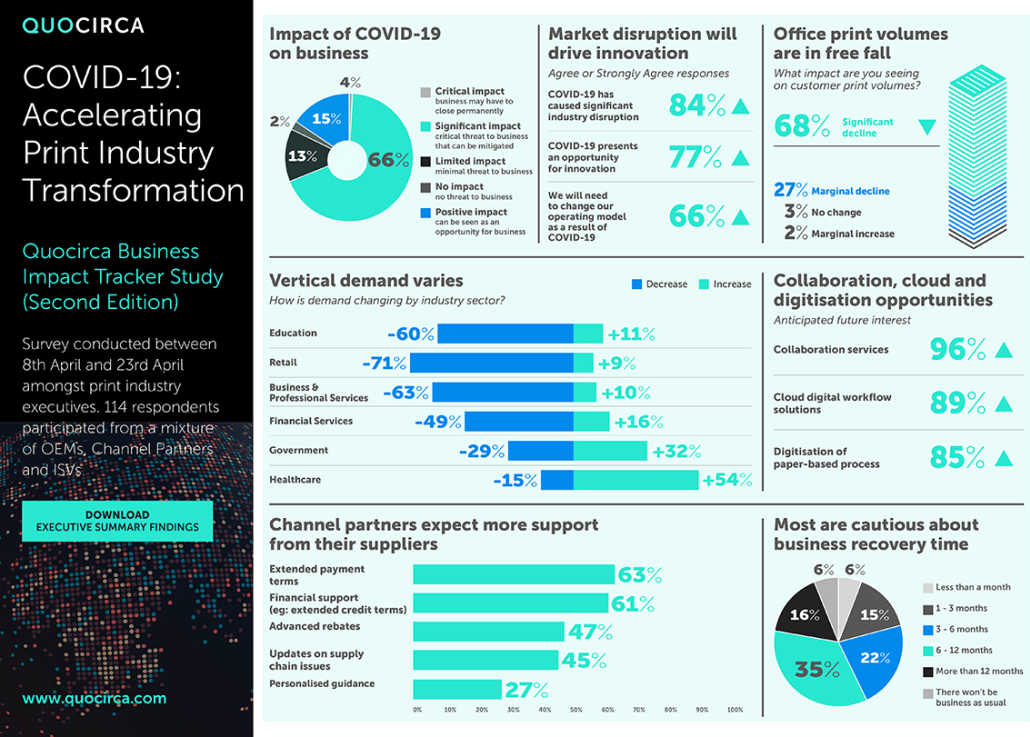

More in the office printing and supplies industry are anticipating change due to COVID-19 than was the case two weeks ago. Two thirds (66%) of respondents in the second snapshot survey say they will need to change their operating model going forward, up from 57% who had reached this conclusion two weeks ago.

Quocirca’s second snapshot survey, tracking the print industry’s response to the pandemic, found the crisis has accelerated the exit from a hybrid document process to digital workflows.

Louella Fernandes (pictured), Director, Quocirca said: “It is clear that, as time is passing, the scale of the pandemic’s effect on business is intensifying. We are seeing positive signs that channel partners are prepared to adapt their strategies and innovate to try to mitigate the effects of the situation, but also that they need help from vendors to do this.”

Louella Fernandes (pictured), Director, Quocirca said: “It is clear that, as time is passing, the scale of the pandemic’s effect on business is intensifying. We are seeing positive signs that channel partners are prepared to adapt their strategies and innovate to try to mitigate the effects of the situation, but also that they need help from vendors to do this.”

Survey respondents recognise that enforced changes to working practices are likely to drive permanent change in the market. One respondent noted: “Print is no longer relevant to businesses.”

According to the Quocirca report, which is now available, it seems the sector’s ingenuity is still going strong, as 58% now plan to introduce new products and services to market to meet anticipated post-pandemic demand (up from 47%). Similarly, 77% see opportunities to drive innovation within their business.

Asked which areas they plan to launch new products and services in, the most popular area was support for remote/homeworking printing, followed by cloud print security services.

The second Quocirca Covid-19 business impact snapshot survey was conducted online between April 8 and 23, 2020. Quocirca received 114 completed responses, 26% from OEMs, 54% from channel organisations and 18% from ISVs. The rest of the respondents fell into the ‘Other’ category. Overall, 72% of respondents were from organisations with fewer than 1,000 employees (65% in the first survey). 52% of respondents were from European organisations (against 44%), 16% from the US (27%) and 32% from other regions (29%).

Long term disruption anticipated

According to the report, OEMs are the most bullish when asked about the future outlook, with 50% expecting to be back to normal within six months. ISVs and channel partners are less optimistic, with 37% of ISVs expecting it to take more than 12 months to get back to normal. However, OEMs have the greatest number of respondents stating that they do not expect there to be a ‘business as usual’ after the crisis is over (11%).

Louella Fernandes said: “OEMs have known for a long time that change is coming, even if the catalyst has been unexpected. They are perhaps, therefore, better positioned to transition to a new normal and certainly, most have the immediate financial resources to be insulated to some degree.

Quocirca is a global market insight and research firm providing strategic market analysis and intelligence to print industry business and technology leaders. Quocirca specialises in analysing the convergence of print and digital technologies in the future workplace.

Get involved:

The third phase of the survey is now live and all industry players are urged to participate.

Related:

Leave a Comment

Want to join the discussion?Feel free to contribute!