HP, GE Additive and EOS Lead 3D Printing Revenue Growth in 2017

Originally written and published at contextworld.com

HP, GE Additive and EOS lead 3D Printing revenue growth for 2017 in hot Industrial sector

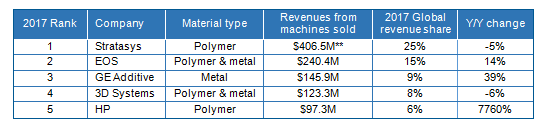

HP, GE Additive, SLM Solutions and EOS all saw at least double-digit year-on-year growth of revenue from 3D printer shipments in the collective Industrial/Professional* market in Q4 2017, leading the way in a period that saw 40% revenue growth in the sector. Stratasys continued to lead in overall revenue share, with these vendors making up the rest of the top 5.

Currently, Stratasys and HP focus on polymer printing alone and top the rankings for polymer-machine revenues, sitting above Carbon and 3D Systems. When it comes to metals 3D printers, GE Additive took over the top market share position thanks to a phenomenal second half of the year. EOS and SLM Solutions join it as global leaders in terms of metals-machine revenues..

Over the year as a whole, long-time market leaders Stratasys and 3D Systems saw revenues from the shipment of machines drop a bit while upstarts GE Additive and HP experienced growth, helping the full Industrial/Professional segment achieve a 23% year-on-year growth in printer revenues. The segment also saw the number of printer units shipped grow for the first time in three years; 11,453 Industrial/Professional printers were shipped in 2017, 5% more than in 2016. Measured by number of units shipped, the leaders for the full year were Stratasys, 3D Systems, EnvisionTEC and EOS with Carbon and HP virtually tied in fifth place.

Table 1: Top 5 3D-printer vendors by revenue from Industrial/Professional* machines shipped in 2017

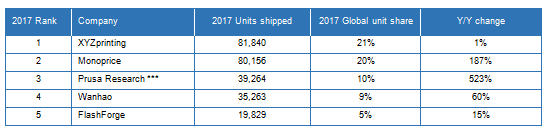

In the Personal/Desktop* sector, XYZprinting saw a growth in unit share of only 1% for the year but still just edged out Monoprice to take back top position globally. Newly accounted for in the full year’s rankings are total shipments from Prusa Research. Prusa particularly excels in kits shipment sales – historically called out in “Others” – but the company’s total aggregate sales for kits and sets are quantified here due to their impact on the market.

Table 2: Top 5 Persona/Desktop* 3D-printer vendors by units shipped in 2017

When the market is separated into a PERSONAL class that covers 3D printers priced under $2,500, and a PROFESSIONAL class encompassing those priced from $2.5K to $20K, Ultimaker and Formlabs lead the PROFESSIONAL class in terms of share. Formlabs’ outstanding 61% year-on-year unit growth has helped to drive significant growth in the segment.

* Industrial/Professional = printers selling above $5,000; Personal/Desktop = printers selling below $5,000

** Revenue may include materials, software or other products.

*** 2017 Prusa Research kits to set ratio is 71% to 29%

Leave a Comment

Want to join the discussion?Feel free to contribute!