HP Reports Q1 Results for Fiscal 2024

HP Reports Q1 Results for Fiscal 2024

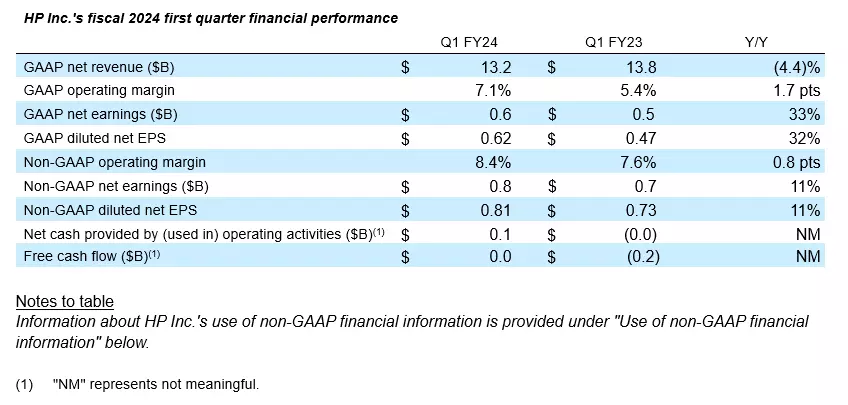

HP and its subsidiaries recently announced its financial performance for the first quarter of fiscal year 2024. The net revenue was $13.2 billion, marking a decrease of 4.4% compared to the preceding year.

HP and its subsidiaries recently announced its financial performance for the first quarter of fiscal year 2024. The net revenue was $13.2 billion, marking a decrease of 4.4% compared to the preceding year.

In terms of operational cash flow, HP generated $121 million, resulting in a free cash flow of $25 million during the first quarter. As of the quarter’s conclusion, HP amassed a gross cash total of $2.4 billion, including $2.3 billion in cash and equivalents, $154 million in restricted cash, and $3 million in short-term investments.

Breaking down the revenue by segment, HP gained a net revenue of $4.4 billion in printing and $8.8 billion in personal systems. Printing revenue saw a decline of 5% from 2023, attributed to a 22% decrease in consumer printing and a 17% dip in commercial printing. Supplies net revenue remained the same as the prior year. Regarding the personal system segment, the net revenue dropped by 4%, with consumer and commercial segments witnessing declines of 1% and 5%, respectively.

Enrique Lores, HP President and CEO, remarked that HP’s Future Ready plan had contributed to the progress in Q1 results. “We are bringing terrific innovation to our customers while driving disciplined execution across every facet of the business. As a result, we delivered solid earnings growth this quarter and we are well positioned to accelerate as the market recovers.”

Looking ahead, HP anticipates a GAAP diluted net EPS ranging from $0.58 to $0.68, and a non-GAAP diluted net EPS between $0.76 and $0.86, allowing for potential fluctuations. For the entirety of fiscal year 2024, HP has established a target of $2.61 to $3.01 for GAAP diluted net EPS, and $3.25 to $3.65 for non-GAAP.

Related:

- Police Seize Thousands of Fake HP Toners in India

- HP CEO Willing to Break Customer Printers Over 3rd-Party Supplies

- Microsoft: HP Not Responsible for Wired Windows 11 Bug

Comment:

Please leave your comment below about the news: HP Reports Q1 Results for Fiscal 2024.

Leave a Comment

Want to join the discussion?Feel free to contribute!