Toshiba Tec Announces Financial Performance for 2023

Toshiba Tec Announces Financial Performance for 2023

Toshiba Tec has disclosed its consolidated business results for fiscal year 2023, ending on March 31, 2024.

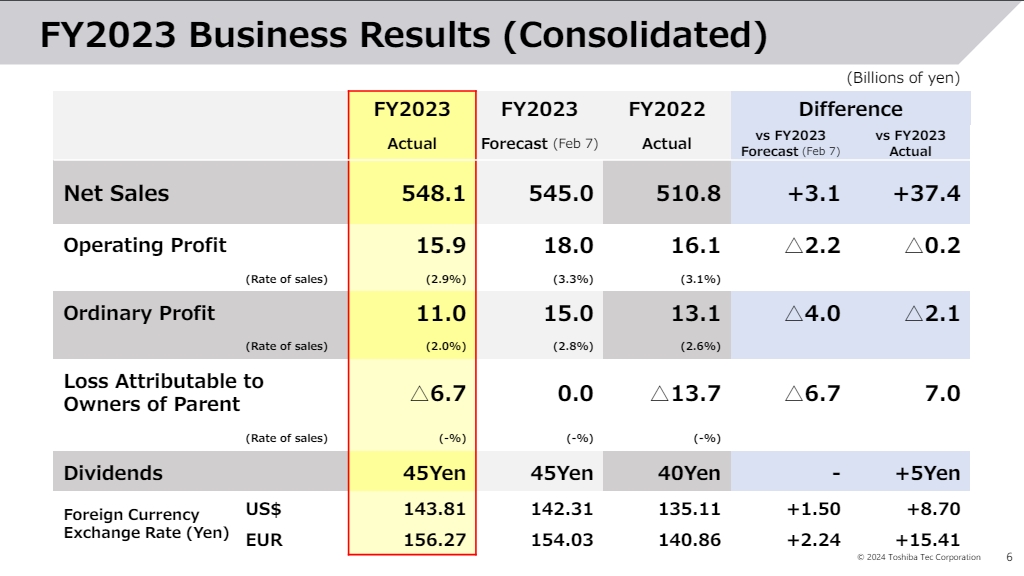

Despite the continual recovery of global economy from the pandemic, Toshiba Tec concluded the fiscal year as ‘uncertain’ due to monetary tightening, China’s economic slowdown, and heightened geopolitical risks. Overall, net sales was JPY¥ 548 billion (USD$ 3.5 billion), up by 7% compared to the prior year. This was mainly attributed to a better performance of multifunction peripherals (MFPs) market as well as the positive effect of foreign exchange rates. Meanwhile, operating profit experienced a slight drop of 1% to JPY¥ 15.85 billion (USD $100 million).

Despite the continual recovery of global economy from the pandemic, Toshiba Tec concluded the fiscal year as ‘uncertain’ due to monetary tightening, China’s economic slowdown, and heightened geopolitical risks. Overall, net sales was JPY¥ 548 billion (USD$ 3.5 billion), up by 7% compared to the prior year. This was mainly attributed to a better performance of multifunction peripherals (MFPs) market as well as the positive effect of foreign exchange rates. Meanwhile, operating profit experienced a slight drop of 1% to JPY¥ 15.85 billion (USD $100 million).

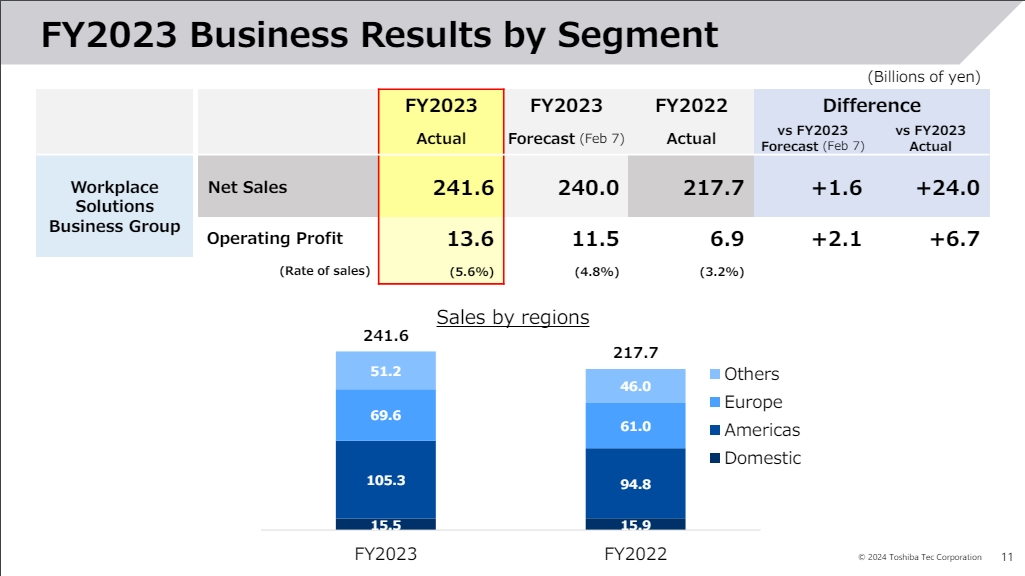

Although printing volume had been declining amid the technological transformation in office environments, the workplace solutions business segment saw a robust growth, with a net sales of JPY¥ 241.63 billion (USD$ 1.54 billion). Operating profit, in particular, went through a drastic surge and topped at JPY¥13.6 billion (USD$ 80 million), almost doubling compared to 2022. This was primary due to an increase in product prices and structural transformation.

Although printing volume had been declining amid the technological transformation in office environments, the workplace solutions business segment saw a robust growth, with a net sales of JPY¥ 241.63 billion (USD$ 1.54 billion). Operating profit, in particular, went through a drastic surge and topped at JPY¥13.6 billion (USD$ 80 million), almost doubling compared to 2022. This was primary due to an increase in product prices and structural transformation.

Toshiba Tec expects global economy to remain uncertain given the concerns about economic slowdowns and financial fluctuations. In line with the corporate policy of contributing to the resolution of social issues, it will construct a strong operational network by strengthening businesses. As one of the measure to be taken in 2024, Toshiba Tec will transfer its MFP business to ETRIA, the joint venture between the company and Ricoh, as well as its inkjet head business to Riso. Both business transfers are scheduled to be effective from July 1, 2024.

Related:

- Toshiba Tec Updates Ink Head Business Transfer

- Toshiba Provides Update on Integration with Ricoh

- Ricoh Provides Updated Joint Venture Plans with Toshiba

Comment:

Please leave your comment below about the news: Toshiba Tec Announces Financial Performance for 2023.

Leave a Comment

Want to join the discussion?Feel free to contribute!