Revenue Expectations Slashed as COVID-19 Bites

Revenue Expectations Slashed as COVID-19 Bites

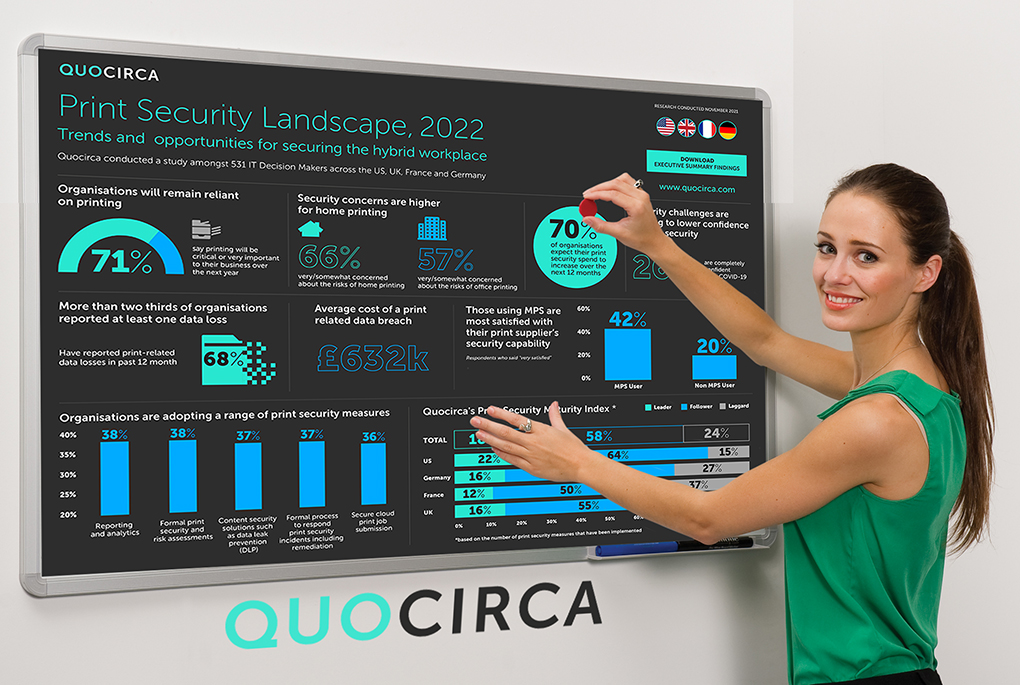

According to Quocirca, 71% of respondents in its third and final COVID-19 Business Impact Survey say they expect revenues to drop, with 38% predicting they will fall by more than 20%.

According to Quocirca, 71% of respondents in its third and final COVID-19 Business Impact Survey say they expect revenues to drop, with 38% predicting they will fall by more than 20%.

Global market insight and research firm Quocirca claims the print industry is braced for a major fall in revenues as the COVID-19 pandemic continues to unfold.

286 Channel, OEM and ISV professionals took part in the third phase of the survey, which was conducted from 1 – 15 May. Channel companies accounted for 73% of respondents, up from 54% in the previous survey. The industry is still expecting significant ongoing disruption, though the figure reporting critical or significant business impact has dropped to 59% from 70% in the second survey. Fewer respondents now believe there are opportunities for their business arising out of the crisis; just 11% agreed with this statement in this survey, down from 15% in the second survey and 21% in the first survey.

Louella Fernandes (pictured), Director of Quocirca comments: “The reality of the impact the pandemic is having on the print industry is becoming clearer. As businesses begin to count the cost, confidence in the opportunities the situation could present has dropped. Nevertheless, there is still recognition of the need for change in operating models and half of the respondents still say they plan to offer new products or services.”

Louella Fernandes (pictured), Director of Quocirca comments: “The reality of the impact the pandemic is having on the print industry is becoming clearer. As businesses begin to count the cost, confidence in the opportunities the situation could present has dropped. Nevertheless, there is still recognition of the need for change in operating models and half of the respondents still say they plan to offer new products or services.”

Changing dynamic between OEMs and Channel partners

Demand for vendor support remains high among channel partners. 57% would like extended payment terms and 48% want advanced rebates, while a fifth need personalised guidance from the OEM for their business.

Comments provided by channel companies indicate that the experience in pandemic has changed how they view vendors. They will look much more critically at those they choose to work with. One respondent commented: “Looking at what OEMs can offer us as support to channel partners will be a crucial element for the choosing of our future OEM partners.”

Fernandes comments: “As the print industry starts to emerge from the immediate crisis, communication between vendors and the channel will be central to recovery. Work should start on jointly developed post-crisis plans. Identifying new business opportunities around supporting home and hybrid workers and developing new services to support the changing business environment must be a shared priority.”

Small signs of recovery

The survey found small signs of recovery in office print volumes. 87% said print volumes among customers are declining, down from 95% who said this in the previous survey. Frontline healthcare and government sectors continue to show an increase in demand for printing, but demand is also slowly returning in the financial services, retail and media sectors, as lockdown measures are eased and more employees return to office working.

Within the industry, there are signs that companies are adapting their corporate approach. 42% of respondents to this survey said they had postponed or cancelled events or product launches, compared with 69% in the previous survey, indicating that companies are switching to virtual alternatives to keep things moving. Similarly, the percentage cancelling major projects or investments dropped from 41% in the second survey to 26% this time.

Despite this, the outlook is uncertain. 57% of respondents overall believe that it will take more than six months for their business to recover.

Fernandes continues: “Confidence is still low in the print industry about the speed of a return to anything recognisable. The impact of the pandemic will continue to reverberate through supply chains and changes to working practices. It will shake up the innovation cycle for the whole industry, forcing early changes to a sector that have been on the horizon for some time.”

This will be the last survey focusing specifically on the pandemic, but Quocirca will continue to account for its effects through its in-depth analysis of the industry as we move forward.

The Quocirca Business Impact Survey phase three report is now available to purchase. It includes recommendations for vendor and channel actions and analysis of the areas for future growth. A complimentary executive summary and infographic may be downloaded here.

Related:

Leave a Comment

Want to join the discussion?Feel free to contribute!