Import Duties Increase in India May Arouse WTO Dispute

Originally written and published by Kirtika Suneja at economictimes.indiatimes.com

Customs hike to hit $65 billion imports, may lead to WTO dispute

The New Delhi government’s decision to increase import duty on a number of products will impact at least US$65 billion worth of imports, and could even land the country in a trade dispute at the World Trade Organization (WTO), experts say.

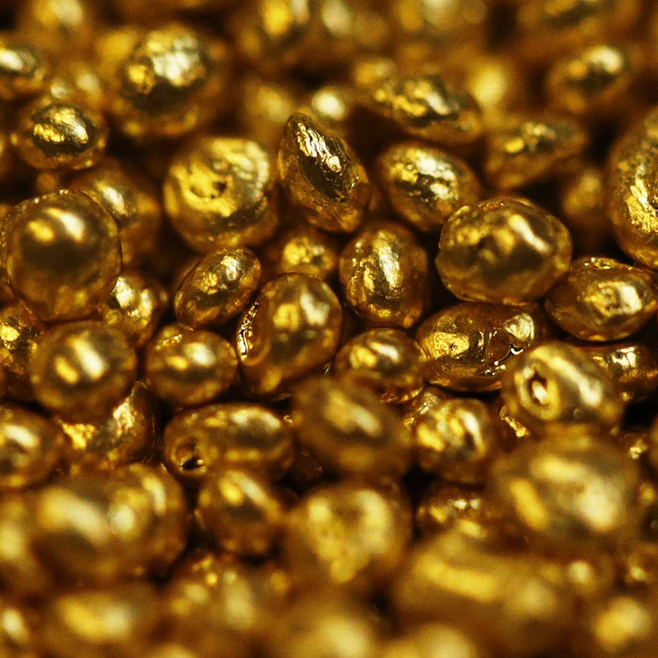

Economictimes.indiatimes.com reports, the Union Budget has proposed higher customs duty on goods, including mobile phones, completely or semi-knocked down automobile parts, electronics, capital goods, edible oils, footwear, imitation jewelries and juices, whose imports in the first seven months of this fiscal year are valued at more than US$38.3 billion. Higher import duties are intended to discourage imports from China and propel the “Make in India” mission forward, and domestic manufacturers also welcome them.

“We are delighted that duties have been increased,” said Vinnie Mehta, director general at Automotive Component Manufacturers Association of India.

He said, “The industry is extremely competitive in these areas and this measure will not only encourage investments but also encourage technological development there.”

Duty on auto components like engine & transmission parts, brakes, suspension, gear boxes and airbags has been increased to 15% from 7.5% in the case of some products and from 10% in the case of others. These items account for more than 50% of US$43.5 billion domestic component industry’s turnover and over 30% of its US$11 billion exports. In the case of electronics, the country imported goods worth US$4.6 billion in December alone, posting almost a yearly 20% rise.

Experts said the move to increase import duty will only have a marginal impact on sales. “The rise in customs duties will not have a major negative impact on sales or customers,” said Arvind Singhal, chairman at Technopak Advisors. “Taxes have been increasing for items which don’t have a huge market size and whose local substitutes are available.”

India imported goods worth US$257.52 billion in the April-October period and US$384.35 billion in 2016-17.

By increasing import duties, the government has provided an arbitrage for domestically produced and imported goods, Singhal said. “There will not be an overall decline in the mobile phone market. In fact, high customs will encourage more indigenization.” He said.

Import duty on mobile phones is proposed to raise to 20% from 15%, while import duty on some mobile phone parts and accessories and certain parts of TVs are increased to 15%. Pankaj Mohindroo, president of the Indian Cellular Association, said about 81% of mobile phones sold in India are made locally.

TRADE DISPUTE

The decision to increase import duty on mobile phones, however, could land India in trouble in the World Trade Organization. Because under the Information Technology Agreement (ITA), signatories can’t impose import duties on many IT products, including mobile phones, some experts said.

“Though ‘Make in India’ is the objective, this measure is a protectionist one,” said an industry representative requesting anonymity.

Anita Rastogi, indirect tax partner at professional services firm PwC India, said, “Increase in customs duty is a trade barrier against the global concept of free trade across countries.” She said India should focus on other methods to boost manufacturing and investments in the country.

“The Make in India is a good scheme, but there are other methods which can help boost local manufacturing industry. It is recommended that our government should give incentives to manufacturers in India, so that we can attract foreign companies to set up their plants in India.” She said.

Leave a Comment

Want to join the discussion?Feel free to contribute!