IDC: China HCP Market Decreases in Q3

IDC: China HCP Market Decreases in Q3

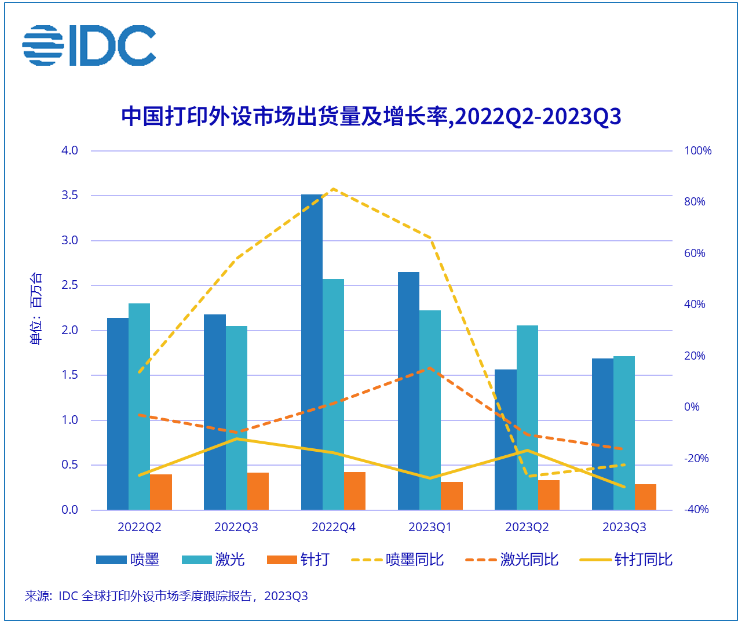

According to IDC China, the shipment of China hardcopy peripherals (HCP) market turned out to be 3.69 million units in the third quarter (Q3), down 20.5% year-over-year or down 6.6% compared to the previous quarter.

Inkjet printer shipment was 1.69 million units, down 22.4% year-over-year, while laser printer shipment registered to be 1.71 million units, down 16.3% year-over-year. Dot matrix printer shipment totaled 0.29 million units, down 30.9% year-over-year.

IDC pointed out that the global economic downturn has led to a downgrade in user consumption and an extension of the procurement cycle, resulting in a significant decline in procurement demand.

The acceptance of ink tank printers in the commercial market has increased, and the year-on-year decline in ink tanks is smaller than that of ink cartridges.

In Q3, the sales of ink cartridge printers increased by 31.4% month-on-month, due to the promotion of the back-to-school season. However, compared with last year, the sales of ink cartridge printers declined year-on-year for two consecutive quarters. Ink cartridge printers are mainly positioned in the consumer market. As the penetration rate of printers in Chinese households increases, printers have gradually become an important learning tool, and low-priced ink cartridge products are still the first choice for many first-time buyers.

Ink tank printers declined year-on-year for the first time this year, and the decline was smaller than that of cartridge printers. The proportion of ink tanks is gradually increasing, and the ratio to ink cartridge products is 50:50. The price of entry-level ink tank printers continues to drop.

Government budgets have shrunk, business purchases have decreased, and commercial market demand has fallen sharply.

In Q3, A4 format laser printers fell by 14.9% year-on-year, of which A4 black and white laser printers fell by 15.4% year-on-year, and A4 color laser printers fell by 8.3% year-on-year. Price-sensitive customers switched from laser to inkjet, accelerating the decline in laser market demand. Color printers have a relatively fixed customer base, and the decline is better than black and white. Mainstream manufacturers have alleviated the oversupply market situation by adjusting their shipment pace and increasing T3 channel promotions.

In Q3, A3 format laser composite machines fell by 27.4% year-on-year, of which A3 black and white laser composite machines fell by 29.0% year-on-year, and A3 color laser composite machines fell by 24.2% year-on-year. A3 demand continues to decline, channel inventory turnover levels are generally high, the overall market shrinks further, user consumption downgrades, and demand migrates from medium to high speed to medium to low speed. Color machines have a greater profit contribution, and manufacturers have strategically turned to color machines. The gap between color machines and black and white machines is narrowing, and the price/performance ratio has improved. Therefore, the decline in demand for color machines is slightly better than that for black and white machines.

IDC believes that commercial market demand will not be released quickly in the short term, and it is recommended that manufacturers and channels focus on key industries and deeply explore customer needs.

Cheng Yana, senior analyst of IDC China’s Printing, Imaging and Document Solutions Research Department, believes that the commercial market will be sluggish in 2023 and will also face greater uncertainty in 2024 due to the impact of internal and external environments.

Related:

- IDC: APEJ HCP Market Shipment Declines in Q2

- IDC: Global HCP Market Shipments Drops in Q2

- IDC: APeJ HCP Market Reports Shipment Growth in Q1

- IDC: Global HCP Shipments Grow in Q1

- IDC: Western European HCP Shipment Declines in Q1

Comment:

Please leave your comments below for the story.

Leave a Comment

Want to join the discussion?Feel free to contribute!