HP Reports Net Revenue Decline in Fiscal 2022 and Q4

HP Reports Net Revenue Decline in Fiscal 2022 and Q4

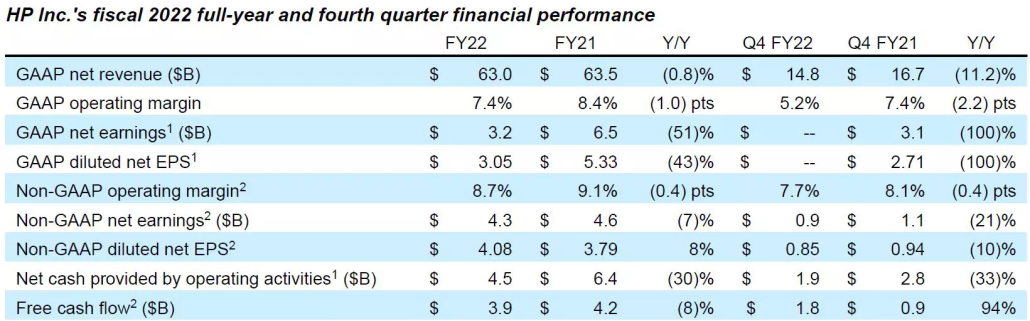

According to HP, fiscal 2022 net revenue turned out to be $63.0 billion, down 0.8% (up 0.7% in constant currency) from the prior-year period.

According to HP, fiscal 2022 net revenue turned out to be $63.0 billion, down 0.8% (up 0.7% in constant currency) from the prior-year period.

Some highlights include:

- Fiscal 2022 GAAP diluted net EPS was $3.05, down from $5.33 in the prior-year period and below the previously provided outlook of $3.46 to $3.56.

- Fiscal 2022 non-GAAP diluted net EPS was $4.08, up from $3.79 in the prior-year period and within the previously provided outlook of $4.02 to $4.12.

- Fiscal 2022 non-GAAP net earnings and non-GAAP diluted net EPS exclude after-tax adjustments of $1.1 billion, or $1.03 per diluted share, related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, Russia exit charges, non-operating retirement-related (credits)/charges, and tax adjustments.

In the fourth quarter (Q4), HP net revenue was $14.8 billion, down 11.2% (down 8.0% in constant currency) from the prior-year period.

Some highlights include:

- Q4 GAAP diluted net EPS was negligible, down from $2.71 in the prior-year period and below the previously provided outlook of $0.44 to $0.54, due to one-time non-cash tax adjustments.

- Q4 non-GAAP diluted net EPS was $0.85, down from $0.94 in the prior-year period and within the previously provided outlook of $0.79 to $0.89.

- Q4 non-GAAP net earnings and non-GAAP diluted net EPS exclude after-tax adjustments of $857 million, or $0.85 per diluted share, related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, Russia exit charges, non-operating retirement-related (credits)/charges, and tax adjustments.

“We had a solid end to our fiscal year despite navigating a volatile macro-environment and softening demand in the second half. In Q4 we delivered on our non-GAAP EPS target, while also completing our three-year value creation plan and exceeding our key metrics,” said Enrique Lores, HP President and CEO. “Looking forward, the new Future Ready strategy we introduced this quarter will enable us to better serve our customers and drive long-term value creation by reducing our costs and reinvesting in key growth initiatives to position our business for the future.”

By segment, Q4 Printing net revenue was $4.5 billion, down 7% year over year (down 6% in constant currency) with a 19.9% operating margin. Supplies net revenue was down 10% (down 10% in constant currency).

Outlook

For the fiscal 2023 first quarter, HP estimates GAAP diluted net EPS to be in the range of $0.47 to $0.57 and non-GAAP diluted net EPS to be in the range of $0.70 to $0.80. Fiscal 2023 first quarter non-GAAP diluted net EPS estimates exclude $0.23 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related (credits)/charges, tax adjustments and the related tax impact on these items.

For fiscal 2023, HP estimates GAAP diluted net EPS to be in the range of $2.22 to $2.62 and non-GAAP diluted net EPS to be in the range of $3.20 to $3.60. Fiscal 2023 non-GAAP diluted net EPS estimates exclude $0.98 per diluted share, primarily related to restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related (credits)/charges, tax adjustments, and the related tax impact on these items. For fiscal 2023, HP anticipates generating free cash flow in the range of $3.0 to $3.5 billion.

Fiscal year 2023 Future Ready Transformation

HP Inc. announced the fiscal year 2023 Future Ready Transformation plan, driving significant structural cost savings through digital transformation, portfolio optimization, and operational efficiency.

The company estimates that these actions will result in annualized gross run rate savings of at least $1.4 billion by the end of fiscal 2025. The company estimates that it will incur approximately $1.0 billion in labor and non-labor costs related to restructuring and other charges, with approximately $0.6 billion in fiscal 2023, and the rest split approximately equally between fiscal 2024 and 2025. The company expects to reduce gross global headcount by approximately 4,000-6,000 employees. These actions are expected to be completed by the end of fiscal 2025.

Related:

- HP Settles Dynamic Security Issue

- HP Reports Revenue Decline in Q3

- HP Launches Cartridge Recycling Initiative in ASEAN

- HP Boasts Crushing 100K Cartridges a Day

- HP Creates Ink Cartridges from Recycled Bottles in Haiti

Comment:

Please leave your comments below for the story “HP Reports Net Revenue Decline in Fiscal 2022 and Q4.”

Leave a Comment

Want to join the discussion?Feel free to contribute!