Aster to Go Public in the US

Aster to Go Public in the US

Planet Image International Limited (“Planet Image”) has applied to go public at Nasdaq, offering 6,000,000 class A ordinary shares at an estimated initial public offering price between US$4.0 and US$5.0 per share.

Located in Xinyu, China, Planet Image designs manufactures and sells a variety of compatible toner cartridges under different labels worldwide.

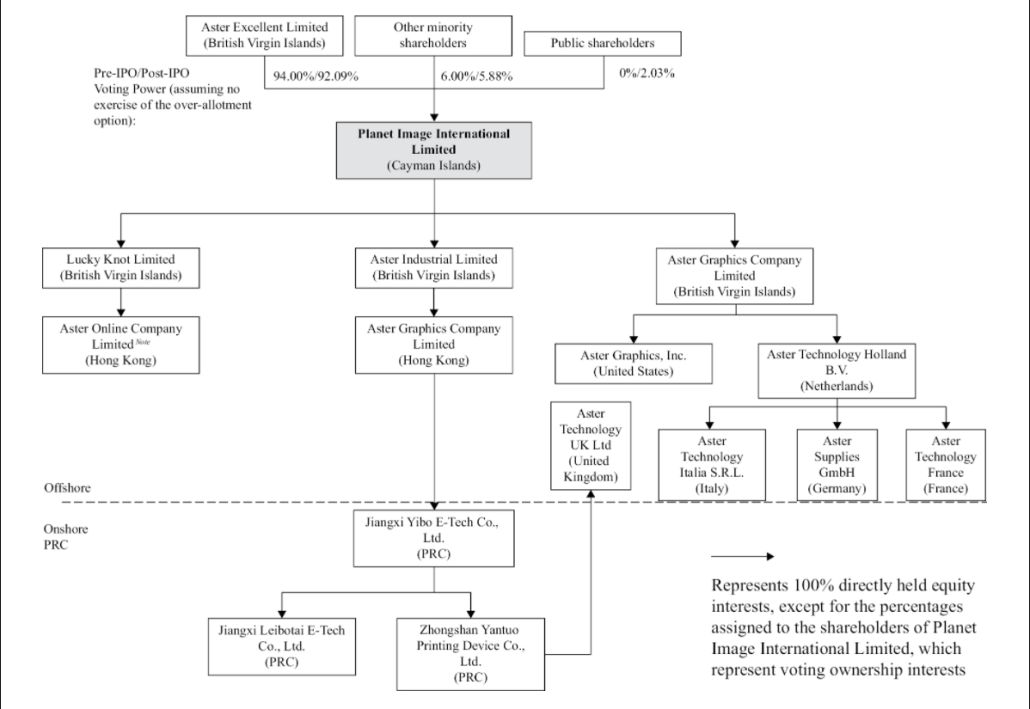

It is reported that Planet Image commenced its operations in January 2011 as a toner cartridge manufacturer through Jiangxi Yibo E-tech Co., Ltd., or Jiangxi Yibo. In March 2011, it incorporated Aster Graphics, Inc., or Aster US. In July 2011, it incorporated Aster Technology Holland B.V. On August 5, 2019, Plant Image International Limited was incorporated under the laws of the Cayman Islands as an exempted company with limited liability.

According to trading-u.com, Planet Image has booked an investment at a market value of US$15 million as of June 30, 2021, from investors including Aster Excellent Limited, Juneng Investment (Hong Kong) and Eagle Heart Limited. Click here for more details.

The company sells its products to others who resell under their own brand names, who design their own versions and direct to end-user customers.

Planet Image has localized sales offices in the US, Italy, France, Germany and the UK. Sales in the US and Europe account for the majority of sales, while Mexico and Poland have seen strong growth in recent years.

In recent years, the company reported an increase in topline earnings, gross profit and gross margin, and a fluctuating operating result. As of June 30, 2021, Planet Image had $34.4 million in cash and $76.4 million in total debt.

Previously, Planet Image tried to apply to go public at the Hong Kong Stock Exchange on April 29, 2020, and November 4, 2020, respectively.

Related:

- Chinese React to Aster Violation of HP Patents in Europe

- Aster Graphics Named in Brother GEO Request

- Aster Secrets Revealed About Going Public

- Aster Ends Court Battle with Giannetta

Comment:

Please leave your comments below for the story.

Leave a Comment

Want to join the discussion?Feel free to contribute!