Ninestar Predicts Making a Profit Albeit Down

Ninestar Predicts Making a Profit Albeit Down

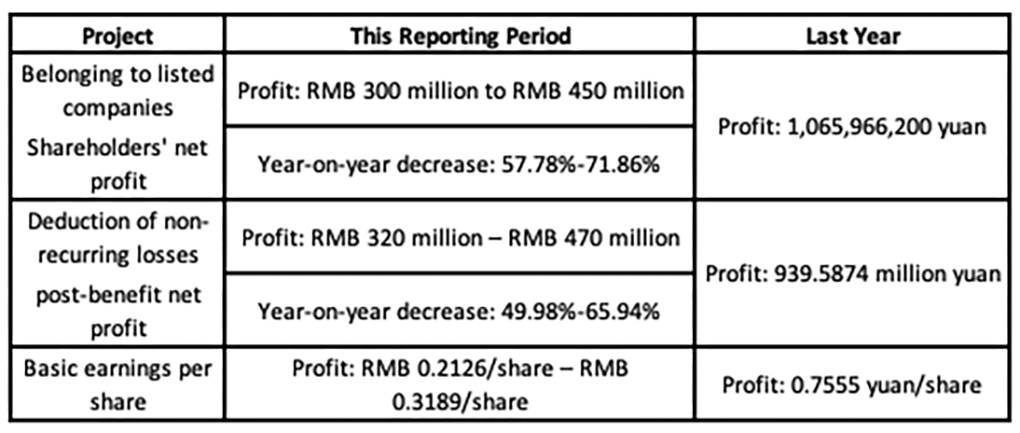

According to Ninestar, the China-based publicly listed company has forecast that the attributable net profit from January and June 2023 will be between US$41.8 million (CNY300 million) and US$62.7 (CNY450 million).

According to Ninestar, the China-based publicly listed company has forecast that the attributable net profit from January and June 2023 will be between US$41.8 million (CNY300 million) and US$62.7 (CNY450 million).

If this is the case, profits will decrease compared to the same period last year between 57.78% to 71.86%.

The announcement also explained this performance:

Printer business

- Pantum Electronics (Pantum): In the first half of 2023, Pantum is expected to achieve an operating income of approximately US$305.6 million (CNY2.191 billion), an increase of approximately 3.68% year-on-year. Sales of printers increased by approximately 7% year-on-year. In the first half of 2023, Pantum’s overseas market shipments increased by more than 30% year-on-year. During the reporting period, Pantum’s A3 printer shipments increased by more than 100% year-on-year.

- Lexmark International (Lexmark): In the first half of 2023, Lexmark International’s operating income was approximately US$1.013 billion, a year-on-year decrease of approximately 13%. Lexmark’s own-brand printer sales increased by approximately 12% year-on-year. However, due to the slowdown in OEM business shipments, Lexmark’s overall printer sales fell by approximately 32% year-on-year. Lexmark’s management report data reveal that the profit before interest, taxes, depreciation, and amortization (EBITDA) is expected to be about 88 million US dollars, a year-on-year decrease of about 33%.

- Compatible printer consumables business (G&G): In the first half of 2023, the operating income of the compatible consumables business is expected to be about US$4.05 billion (CNY2.911 billion), a year-on-year decrease of about 5.95%.

- Integrated circuit business (Geehy): In the first half of 2023, Geehy’s (formerly Apex) operating income will be about US$107.12 million (CNY770 million), a year-on-year decrease of about 27%. Total chip sales increased by approximately 13.5% year-on-year (including sales of non-consumable chips increased by 74% year-on-year). During the reporting period, Geehy increased its R&D investment in automotive and industrial control high-end products, and the research and development expenses were about US$32 million (CNY230 million), a year-on-year increase of about 30%. In the first half of the year, a total of 2 automotive and industrial control M4 core products were launched. In the second half of the year, Geehy will continue to accelerate the deployment of new products in high-end product applications such as automotive electronics, industrial control, and new energy. A variety of new MCU chip products will be released in succession in 2023.

Ninestar’s 2023 first quarterly report shows that the company’s main operating income was US$908.1 million (CNY6.519 billion), a year-on-year increase of 11.75%; Investment income is US$491.4 million (CNY4.245 million), the financial cost is US$46.1 (CNY331 million), and the gross profit rate is 34.88%.

Related:

Comment:

Please add your comments below about this news story, “Ninestar Predicts Making a Profit Albeit Down.”

Leave a Comment

Want to join the discussion?Feel free to contribute!