LockDown Drives Up Inkjet Sales in Europe

LockDown Drives Up Inkjet Sales in Europe

A spike in consumer printer demand during COVID-19 lockdowns has helped overall sales through European distributors grow by 2.2% year-on-year in the first 18 weeks of 2020, according to CONTEXT, the IT market intelligence company.

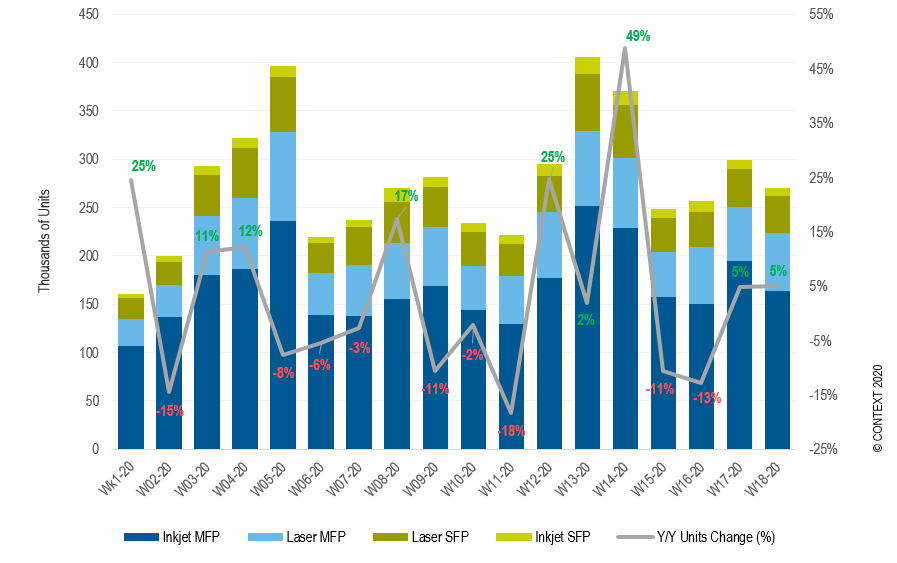

Graph 1: Printer volumes and Y/Y change by category – European distribution

The latest data indicates that, although not as essential to home working and studying as products like computers and headsets, printers became more popular in March and April as households began to see the value of having a device at a time of mass school and office closures.

Consumer unit sales across Europe spiked by 72% year-on-year in week 14 (ending April 5) and by 52% in week 12 (ending March 22).

However, although the retailer consumer and retail channels accelerated their purchasing in Q1 2020 due to concerns over supply instability, revenues fell by -10.6% year-on-year. This was due to falling ASPs and a greater focus on consumer products (cheaper entry-level and mid-range models) than in the same period last year.

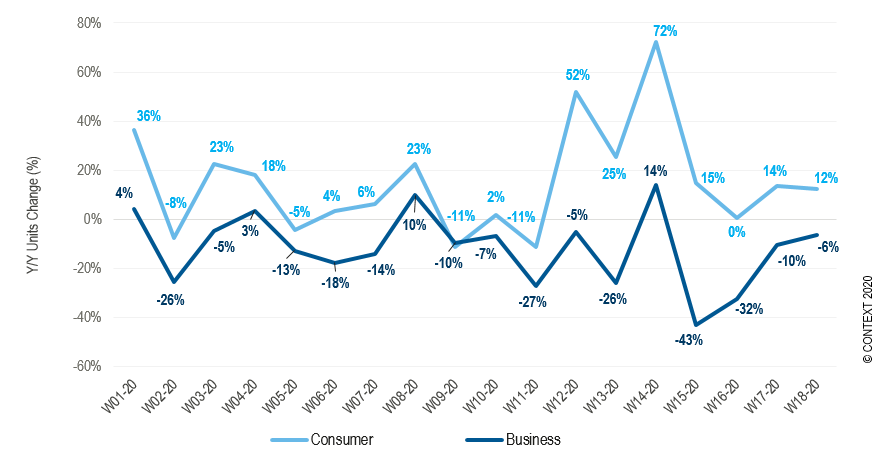

In fact, consumer printers dominated the first 18 weeks of 2020, accounting for 64% of sales and growing by +11.7%, while unit sales in the business segment fell sharply at -14.4%.

In fact, consumer printers dominated the first 18 weeks of 2020, accounting for 64% of sales and growing by +11.7%, while unit sales in the business segment fell sharply at -14.4%.

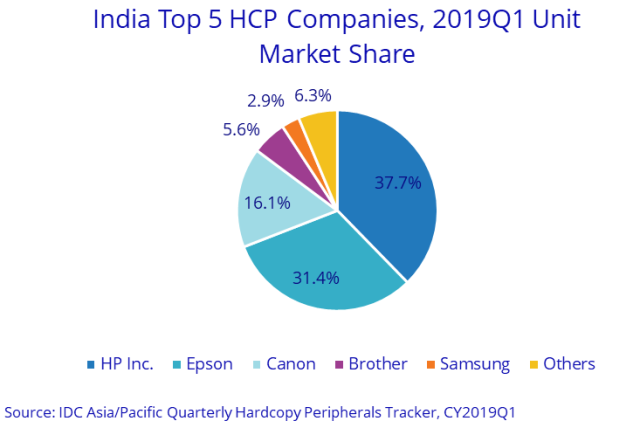

Brother (+33%), Canon (+18%), HP (+17%) and Epson (+11%) saw significant year-on-year sales increases in the consumer space as a result, although most brands benefitted, while in the commercial space just four vendors saw double-digit growth: Brother (+17%), Canon (+16%), Xerox (+14%) and Epson (+10%).

Graph 2: Y/Y change in printer sales by segment – European distribution

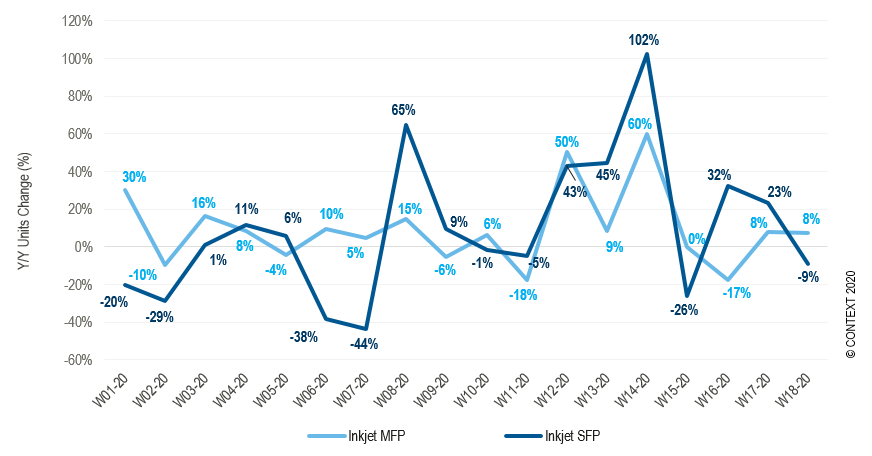

Inkjet MFPs and SFPs were the winners: European distributors sold more of these models in almost every single week than at the same time in 2019. A shortage of consumer printers also forced many buyers to purchase entry-spec business inkjet MFPs, driving up revenues.

Overall inkjet sales have risen 30% year-on-year due in part to ink-tank models that are appealing to consumers looking for more durable home essentials.

Graph 3: Y/Y change in inkjet sales by function – European distribution

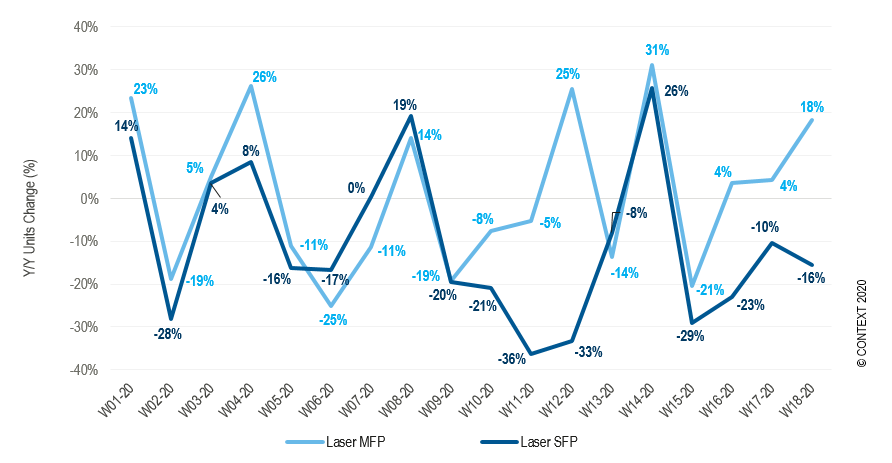

Laser printers have had a less successful year thus far, with neither the business nor the consumer segment matching 2019 performance. Overall sales during the first 18 weeks of 2020 were down by -7.2% year-on-year (and revenue by -17.5%), mainly due to falling business demand. However, sales of laser MFPs aimed at consumers grew by +29%, driven mainly by cheaper models of up to €150.

Graph 4: Y/Y change in laser printer sales by function – European distribution

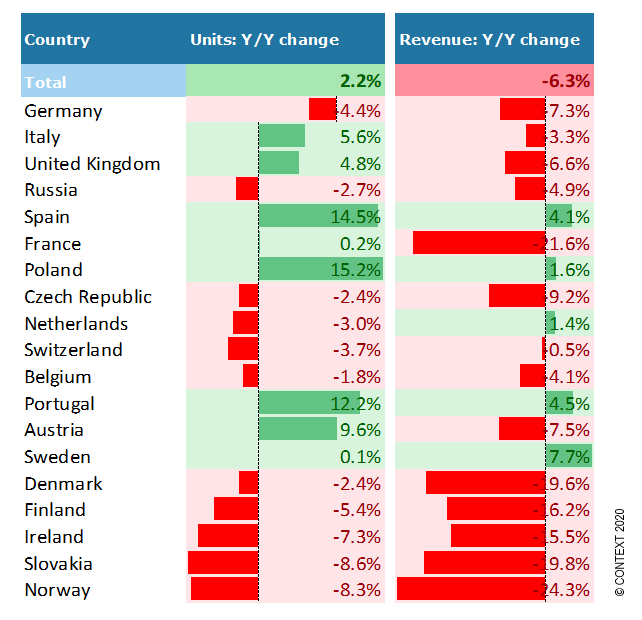

The story in each of the major Western European countries was slightly different, and it reflects differences in the timing and nature of measures implemented by Governments to control the spread of the virus. Only Spain recorded unit sales and revenue growth, with most countries showing declining revenues even as volume sales increased.

Table 1: Imaging units sold and revenue: Y/Y change for W1–W18 2020 – European distribution

Although there is no sign of recession, a prolonged lockdown across Europe could leave vendors and distributors with excess inventory, especially business laser printers.

Related:

Leave a Comment

Want to join the discussion?Feel free to contribute!