HP Stays Positive with Q1 Results

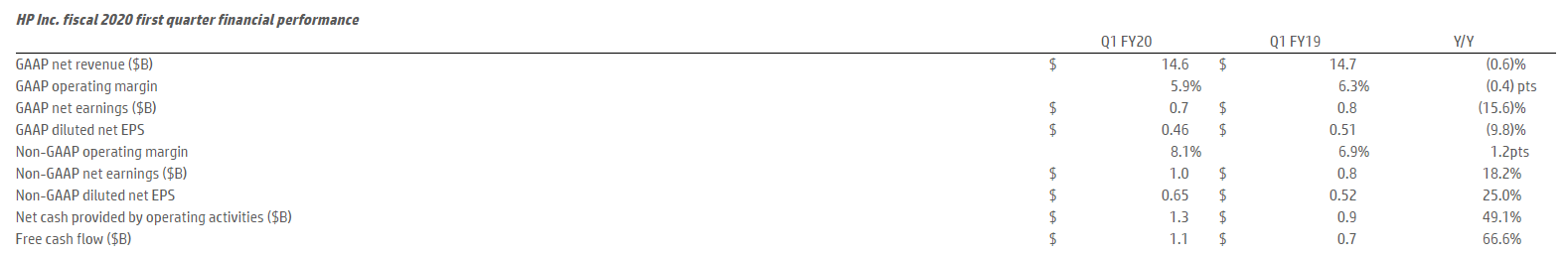

HP Inc. and its subsidiaries (“HP”) announced fiscal 2020 first quarter net revenue of $14.6 billion, down 0.6% (up 0.5% in constant currency) from the prior-year period.

Some main results include:

“Our Q1 results reflect a business that is strong and getting stronger. Our non-GAAP EPS growth of 25% was significantly above our guided range, driven by tremendous execution against our strategic priorities,” said Enrique Lores, President and CEO, HP Inc. “This is a team at the top of its game, combining the industry’s best innovation with disciplined execution and cost management to deliver for our shareholders. We have great confidence in our plans and are raising our full-year earnings outlook.”

Asset management

HP’s net cash provided by operating activities in the first quarter of fiscal 2020 was $1.3 billion. Accounts receivable ended the quarter at $4.9 billion, down 5-days quarter over quarter to 30 days. Inventory ended the quarter at $4.9 billion, down 3-days quarter over quarter to 38 days. Accounts payable ended the quarter at $12.8 billion, down 9 days quarter over quarter to 98 days.

HP generated $1.1 billion of free cash flow in the first quarter. Free cash flow includes net cash provided by operating activities of $1.3 billion adjusted for net investment in leases of $34 million and net investment in property, plant and equipment of $198 million.

HP’s dividend payment of $0.1762 per share in the first quarter resulted in cash usage of $0.3 billion. HP also utilized $0.7 billion of cash during the quarter to repurchase approximately 33.8 million shares of common stock in the open market. As a result, HP returned 84% of its first quarter free cash flow to shareholders. HP exited the quarter with $4.5 billion in gross cash, which includes cash and cash equivalents and short-term investments of $0.3 billion included in other current assets.

Fiscal 2020 First quarter segment results

- Personal Systems net revenue was up 2% year over year (up 4% in constant currency) with a 6.7% operating margin. Commercial net revenue increased 7% and Consumer net revenue decreased 7%. Total units were up 4% with Notebooks units up 2% and Desktops units up 7%.

- Printing net revenue was down 7% year over year (down 6% in constant currency) with a 16.0% operating margin. Total hardware units were down 10%. Commercial hardware revenue was down 1% and Consumer hardware revenue was down 13%. Supplies net revenue was down 7% (down 7% in constant currency).

More information on HP’s earnings, including additional financial analysis and an earnings overview presentation, is available on HP’s Investor Relations website at www.investor.hp.com.

HP’s FY2020 Q1 earnings conference call is accessible via an audio webcast at www.hp.com/investor/2020Q1Webcast.

(Source: https://investor.hp.com/news/)

Related Reading:

HP Takes Weeks To Answer Xerox Bid

Leave a Comment

Want to join the discussion?Feel free to contribute!