Five 2025 Trends Defining the Printing Industry

Five 2025 Trends Defining the Printing Industry

At this year’s PRINTING United Expo, the Alliance Insights research team offered an in-depth look at the forces shaping the printing industry, as reported by Printing Impressions. Vice President Nathan Safran, Principal Analyst Lisa Cross, and Economist Onamica Dhar shared highlights from a series of new and upcoming reports, covering everything from market performance to automation, convergence, tariffs, and artificial intelligence.

Tariffs Tighten the Squeeze

Tariffs remain a significant drag on profitability. More than 93% of printers say they’ve already felt the effects, and most expect further cost increases next year. Nearly two-thirds anticipate shrinking profit margins and close to half foresee additional supply chain disruption. Although 95% have raised prices to compensate, many are also trying to offset the impact through better efficiency or by absorbing part of the added costs. Some plan to respond through more transparent communication with customers, shorter estimate windows, higher inventory levels, or sourcing from new suppliers.

Uneven Growth Amid Rising Costs

Preliminary results from the State of the Industry study suggest a mixed picture for 2025. Average sales rose by just 0.6% over the first three quarters, with roughly one in three printers reporting growth and the rest holding steady or losing ground. Inflation continues to pressure margins: while costs rose for about 70% of businesses, fewer than half adjusted their pricing due to client resistance. Printers cited boosting sales, protecting profitability, and managing higher labor and material costs as their top concerns heading into 2026. Most respondents are focusing on efficiency, with over 70% planning productivity and cost-control initiatives and 61% prioritizing automation investments.

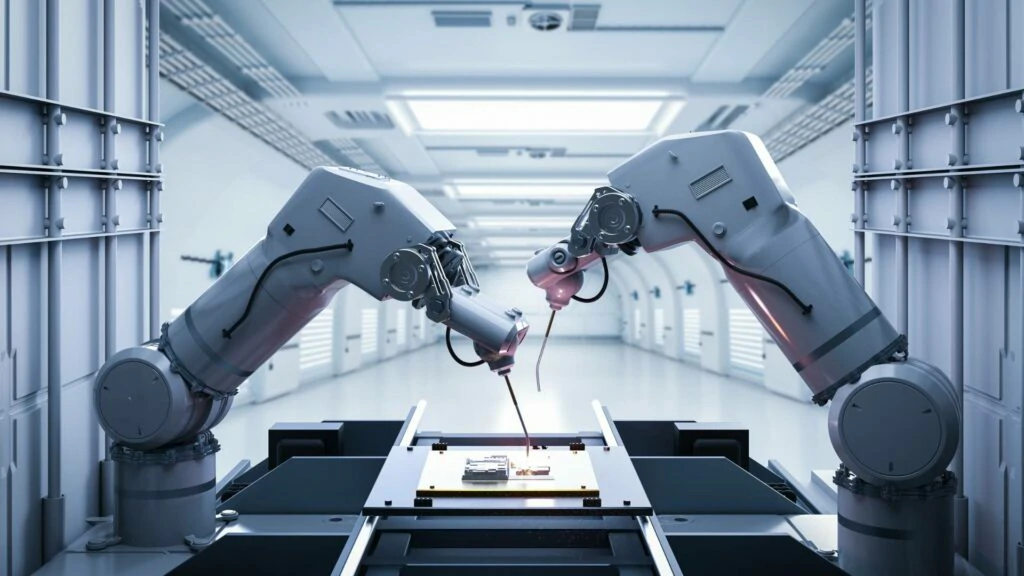

Automation Gaps Reveal Industry Divide

Automation has become a top strategic priority but remains underutilized. Cross reported that nearly eight in ten commercial printers and two-thirds of wide-format printers still rely heavily on manual workflows. Yet, most companies recognize automation as essential to future competitiveness—87% believe it strengthens resilience, and 85% call it critical for staying viable. The research suggests the market is splitting between forward-looking “leaders” investing in technology and those at risk of falling behind.

Convergence Gains Ground Across Print Segments

The movement toward convergence—where printers expand beyond traditional categories—is accelerating rapidly. According to Alliance Insights, 96% of print service providers now operate in multiple segments, a reflection of customers increasingly seeking single-source vendors. About 90% of printers say advances in print technology and automation have made diversification easier. Those that have embraced convergence are seeing clear payoffs: 15.6% report higher revenues and just over 10% note improved profitability after expanding into new service areas.

Artificial Intelligence Moves Mainstream

AI is emerging as one of the most transformative forces in printing. Safran said roughly 85% of printers have already implemented or are testing AI tools, an adoption rate faster than any prior technology in the industry. Most respondents report that AI not only boosts efficiency but also creates new business opportunities. However, the data shows a widening performance gap between companies experimenting actively with AI and those standing still. Leading adopters cite gains in consistency, quality, and staff productivity, while early-stage applications in analytics and decision-making hint at even broader disruption ahead.

Related:

- AI & Environmental Regulations to Reshape Print Industry

- UK Government Awards £900 Million to Printing Suppliers

- Romanian Ministry Faces Criticism Over Toner Procurement

- Eco-Friendly Inks Market Enters Rapid Growth Stage

- IDC Releases China’s Printer Market Report for H1 2025

Comment:

Please leave your comment below about the news: Five 2025 Trends Defining the Printing Industry.

Leave a Comment

Want to join the discussion?Feel free to contribute!