Epson Revision of Financial Results Forecast 2020

Epson Revision of Financial Results Forecast for the Year Ending March 2020

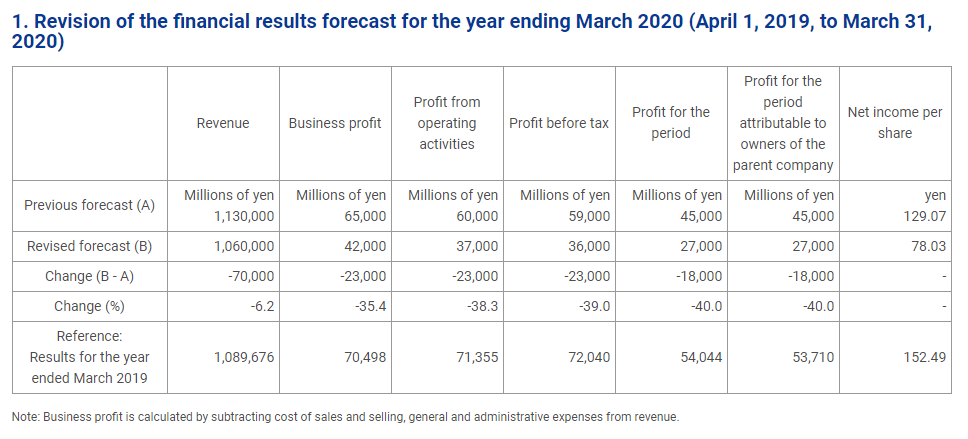

Seiko Epson Corporation announced that its board of directors had approved a revision of its financial results forecast for the year ending 2020, disclosed on July 30, 2019.

In addition to a stronger than expected yen affecting the exchange rates with the euro and emerging market currencies, Epson’s business environment was influenced by a greater than anticipated decline in the Chinese and Indian economies, and the impact of China-United States trade friction on investment and other factors in the United States and Europe.

According to Epson’s declaim on their web, “Against this background, we forecast overall revenue to come in below the previous forecast. High-capacity ink tank printers, in which we have boosted sales efforts with the aim of driving future growth, are forecast to achieve our initial volume target (approx. 10.2 million units) in emerging markets and developed economies such as the United States and Europe. This is counterbalanced by the sudden decline in the aforementioned foreign exchange situation and economic conditions, and lower than expected results in the company overall, especially in projectors and robots.”

Epson are also revising the forecast in each profit category. Although in the light of the current business environment Epson are making efforts to improve profitability by strictly assigning priorities to investments, they have taken into consideration revised foreign exchange assumptions that accompany the strengthened yen and which form the base of the financial forecasts, in addition to a greater than anticipated revenue decline caused by a worsened market situation.

Epson are setting our foreign exchange assumptions for the third quarter onwards at 105 yen to the US dollar, and 115 yen to the euro, also standing by the dividend forecasts of 62 yen per share.

For further information, please kindly view here.

Leave a Comment

Want to join the discussion?Feel free to contribute!