Xerox Releases Third-Quarter Results, Raises 2019 Guidance

Xerox Releases Third-Quarter Results, Raises 2019 Guidance

Cash Flow, Earnings Per Share and Profit Margins Increase and Revenue Trend Improves from Prior Quarters

Recently Xerox Holdings Corporation announced its third quarter 2019 financial results and said it would raise 2019 guidance for Earnings Per Share and cash flow. “Our strategy and execution delivered a strong third quarter despite industry headwinds. We increased cash flow, earnings per share and adjusted operating margin while we improved the revenue trend. These results give us confidence to raise our earnings and cash flow guidance for the year as we position Xerox for long-term growth,” said Xerox Vice Chairman and CEO John Visentin.

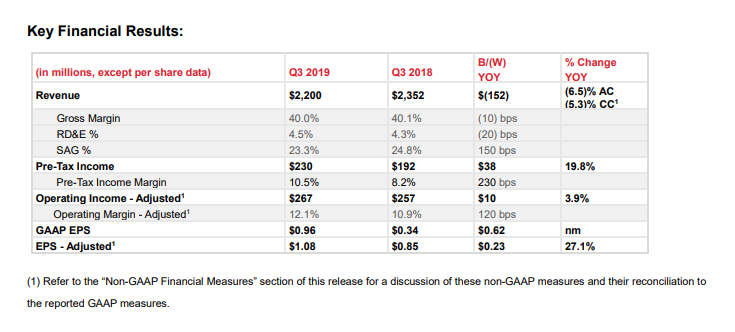

Third-Quarter 2019 Financial Summary:

- $356 million of operating cash flow, up $82 million year-over-year, and $339 million of free cash flow, up $88 million year-over-year

- GAAP earnings per share (EPS) of $0.96, up $0.62 year-over-year, and adjusted EPS of $1.08, up $0.23 year-over-year (YOY)

- $2.2 billion of revenue in the quarter, a decrease of 6.5 percent in actual currency, or 5.3 percent in constant currency, year-over-year

- Increasing 2019 guidance for GAAP EPS to $3.10 – $3.20, adjusted EPS to $4.00 – $4.10, operating cash flow to $1.2 – $1.3 billion and free cash flow to $1.1 – $1.2 billion

- Completed $368 million of share repurchases through the third quarter, expecting at least $600 million in total for the year

About Xerox

Xerox Holdings Corporation is a technology leader focused on the intersection of digital and physical. Xerox use automation and next-generation personalization to redefine productivity, drive growth and make the world more secure. Every day, their innovative technologies and intelligent work solutions-Powered by Xerox®-help people communicate and work better. Discover more at www.xerox.com.

Leave a Comment

Want to join the discussion?Feel free to contribute!