APEJ 3D Spending Expected to Reach 3.6 Billion by 2021

Originally Written by IDC

A forecast from the IDC Worldwide Semiannual 3D Printing Spending Guide, expects Asia/Pacific spending on 3D printing (including hardware, material, software, and services) to reach US$3.6 billion by 2021 (with a five-year compound annual growth rate (CAGR) of 22.4%).

APEJ is one of the three largest regions along with The United States and Western Europe, delivering 18% of the total 3D printing spending worldwide throughout the 2017-2021 forecast period.

3D printing related services (including consulting services, systems integration services and on-demand part services) and material spending combined is said to deliver nearly 45% of the total spending in the region throughout the forecast period.

Purchase of software will trail behind in the overall market with five-year CAGR of 26.9%.

“China is the force behind APEJ growth. The Chinese Government is in support of the industry and multiple 3D printing action plan and fiscal supports are seen in place. As a result, it boosted the 3D printing uses and spending in the country with continuous interest and rising maturity,” said Mun Chun Lim, Market Analyst, of IDC Asia/Pacific’s Imaging, Printing and Document Solutions Research.

According to IDC, discrete manufacturing is the dominant industry with in APEJ, with spending expected to be nearly US$1.1billion in 2018. This industry is expected to remain the largest spending in the region throughout the forecast period, reaching US$1.7billion in 2021.

Education and healthcare provider industry falls after discrete manufacturing industry, which will account 37% of the overall spending in total across the region in 2021. “Manufacturers in APEJ have started to evaluate and implement additive manufacturing. Coupled with government push in advanced manufacturing, the discrete manufacturing industry will continue to dominate majority of the spending in the region,” adds Lim. “Education remains to be the focus in majority of the countries across the region while healthcare industry is gaining traction with rising demand of customized medical solutions and increasing spending power among patients in the region.”

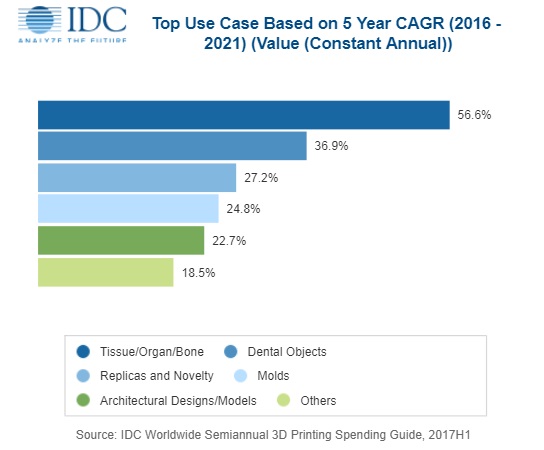

Leading use cases for 3D printing in discrete manufacturing, is said to include prototypes, molds and aftermarket parts. These three cases will account for 68% of total spending across the discrete manufacturing industry in 2018.

IDC predicts that the industries that will see the fastest growth in 3D printing spending over the five-year forecast are the telecommunications industries (50.2% CAGR) and resource industries (44.0% CAGR).

“As we are gearing towards industry 4.0 era, 3D printing is poised to transform the manufacturing process and how things are made. The advent of 3D printing opens up endless possibilities and unleashing disruptive power in global supply chain. With on-going development, we will see the penetration of 3D printing in other industries, with more innovative use cases developed,” said Lim.

Leave a Comment

Want to join the discussion?Feel free to contribute!