3D Systems Corporation Stock Short Badly

Originally published at Yahoo

3D Printer Stock Put Options Could Triple, Says Signal

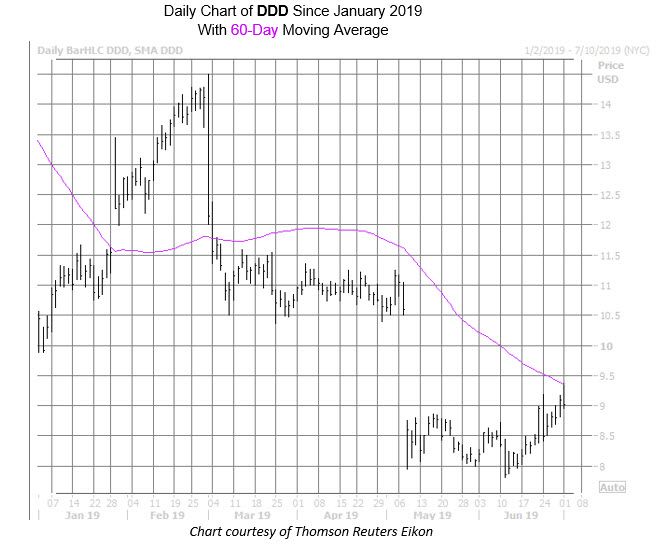

The 3-D printing concern 3D Systems Corporation has been suffering on the charts after an early May bear gap caused the stock to bottom out at a two-year low of $7.81 in mid-June. While the beginnings of a rally can be seen on the charts, the stock quickly lost steam at its 60-day moving average today. This wouldn’t be the first time DDD has run up to this trendline and failed — and, if history is any indicator, it could mean even more downside for the stock in coming weeks.

According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, DDD has tested resistance at its 60-day moving average five times over the last three years. The security was positive two weeks later only 20% of the time and averaged a 14.14% loss. From its current perch at $9.02, a similar move would have DDD shares trading at a new three-year low around $7.74 over the next 10 days.

And now is the time to bet on DDD’s next leg down with options. 3D Systems’ Schaeffer’s Volatility Index (SVI) of 46% is higher than only 3% of all other readings from the past year. This means short-term options players are pricing in relatively low volatility expectations. In the wake of this bearish technical signal for DDD, and assuming the stock’s option implied volatilities (IVs) hold around historical two-year averages over the next 10 days, the expected at-the-money put option return over this time frame is 249%.

A rejection at trendline resistance could also embolden DDD shorts. The number of shares sold short rose by 4% over the most recent reporting period, and short interest now accounts for 23.3% of the equity’s float. With these bears firmly in control, a renewed push to sell into the stock’s recent relative strength could translate into additional headwinds for DDD.

Leave a Comment

Want to join the discussion?Feel free to contribute!