Xerox Farewells Billionaire Activist Investor

Xerox Farewells Billionaire Activist Investor

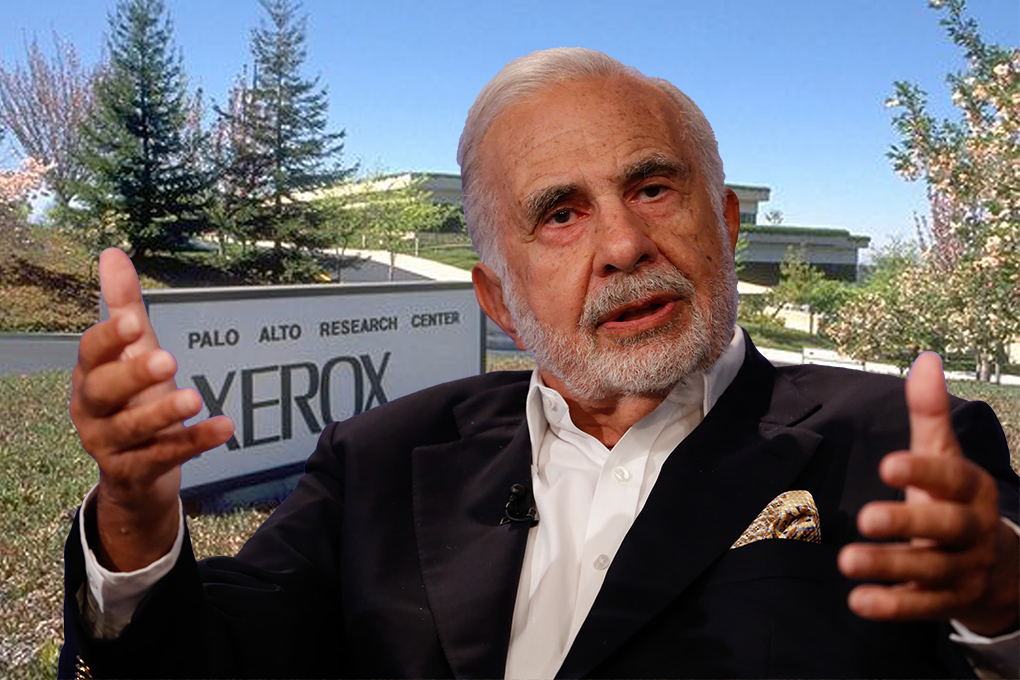

Shares of Xerox Holdings Corp. XRX, -1.81% slipped last Thursday (September 28) after the printer OEM decided to buy back all of its shares owned by activist investor Carl Icahn (pictured).

Shares of Xerox Holdings Corp. XRX, -1.81% slipped last Thursday (September 28) after the printer OEM decided to buy back all of its shares owned by activist investor Carl Icahn (pictured).

“Our decision to repurchase shares is reflective of the confidence we have in our business, our strategy and our ability to improve Xerox profitability and cash performance,” said Chief Executive Steve Bandrowczak. “For nearly a decade, Carl and his affiliates have served as important shareholders to Xerox, providing invaluable counsel, guidance and activism to support our evolution as a workplace technology leader.”

Xerox said it will pay $15.84 per share for Icahn’s stake, for a total cost of $542 million. The price paid is where the stock closed Wednesday, prior to adjustments made for the payment of the quarterly dividend of 25 cents a share.

Industry Analysts’ Andy Slawestzky, wrote, “For many who’ve closely followed Xerox’s journey over the years, this decision symbolizes a moment of rejuvenation. Carl Icahn, renowned for his assertive and often aggressive investment strategies, has indeed been instrumental in guiding Xerox through its numerous transitions. His push for cost-cutting measures and his pursuit of consolidation within the printing industry were pivotal in streamlining Xerox’s operations.

“However, there’s an underbelly to Icahn’s involvement: Xerox was stripped down, sometimes painfully, to its core. He’s chased out Xerox CEOs. He went to war with their biggest competitor (HP) in a hostile takeover bid. He dominated the board and was responsible for cutting 10s of thousands of jobs. While this downsizing potentially led to short-term profits, there remained concerns about the company’s long-term innovation, growth, and commitment to its partners, especially the resellers.”

According to Slwtesky, resellers will be the real winners from this action. He cites three reasons:

- Renewed Focus on Innovation: there’s an expectation that Xerox will recommit to its legacy of innovation meaning resellers may be able to obtain cutting-edge products and solutions to meet the demands of an evolving market.

- Stability and Confidence: Xerox’s decision to purchase the shares sends a message it is confident about its future and this will provide a sense of stability for resellers.

- Enhanced Partner Relationships: Xerox can focus on strengthening its relationships and this means resellers can anticipate better engagement, training, and support.

Slawtsky added, “The buyback signals more than just a change in stock ownership. It’s a statement of intent. Xerox, an iconic brand with over 100 years of legacy, is ready for its next chapter. For the vast network of resellers and millions of customers, the hope is that this chapter will be marked by renewed dedication, innovation, and unparalleled value. With Icahn out of the picture, Xerox will hopefully find stability and a renewed dedication to their customers.”

Related:

- Xerox Named Leader in Print Security

- Xerox Says On Track for a Profitable 2023

- Carl Icahn Invests More in Xerox

- Carl Icahn Increases Investment in Xerox

- Carl Icahn Sued by Xerox Shareholder

- Icahn, Deason to Oust Xerox CEO

Comment:

Please add your comments below about this story, “Xerox Farewells Billionaire Activist Investor .”

Leave a Comment

Want to join the discussion?Feel free to contribute!