HP Reports Solid Printing Profitability in 1Q2014

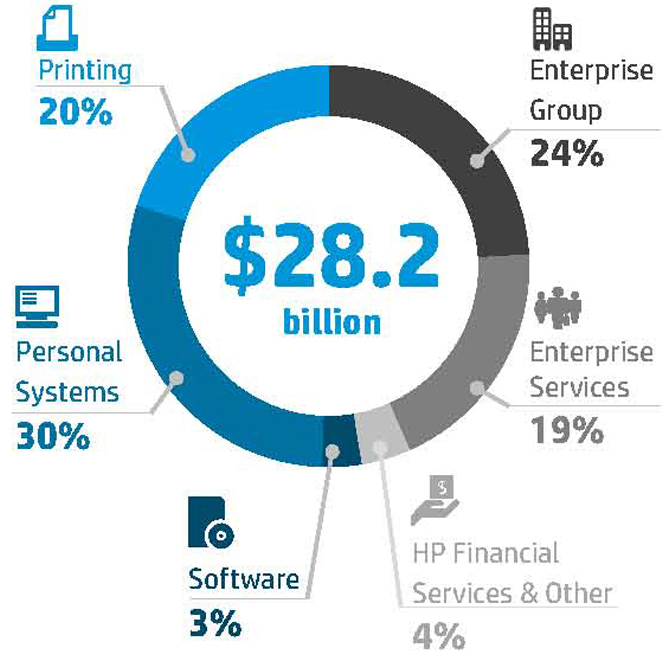

Hewlett-Packard (HP) has released its first quarter financial results of 2014 (1Q2014). Net revenue was $28.2 billion, down 1% from the prior-year period. Non-GAAP diluted net earnings per share increased to $0.90, up 10% from the same quarter a year ago.

Hewlett-Packard (HP) has released its first quarter financial results of 2014 (1Q2014). Net revenue was $28.2 billion, down 1% from the prior-year period. Non-GAAP diluted net earnings per share increased to $0.90, up 10% from the same quarter a year ago.

In 1Q2014, HP’s printing profitability remained solid with $5.8 billion revenue, down 2% year-over-year (YOY). Operating profit of this segment was about $1 billion, capturing 16.8% of total revenue. Supplies revenue decreased 3% YOY, representing 65% of printing revenue. Total Hardware units were up 5% YOY. Commercial hardware revenue was $1.3 billion, dropping 2% YOY. Consumer hardware revenue was $673 million with a 1% decrease YOY.

HP found that due to the tough pricing environment and the effective currency exchange rate, the average selling prices of ink and laser hardware are decreasing. However, the demand for HP ink in Office Products remained strong. In addition to the double-digit sequential growth of the HP Office Jet Pro X across all regions, Ink Advantage embraced a double-digit, YOY revenue and unit growth. Also, HP noted it “gained share and are continuing to grow in multifunction printers and managed services, and graphics remains a bright spot, with another solid performance in Indigo”.

By region, the revenue of the American market was $12.5 billion, with 2% YOY decrease. HP said the decline was mainly caused by “key account runoff in Enterprise Services in the US, partially offset by a previously announced sale of Intellectual Property”. EMEA (Europe, Middle East and Africa) revenue was $10.4 billion, a 1% YOY increase, while revenue of Asia-Pacific market was down 1% YOY, gaining $5.2 billion of revenue. HP noted it is pleased with the flat China market, due to overall market challenges in the region.

Meg Whitman, HP President and Chief Executive Officer, said, “HP is in a stronger position today than we’ve been in quite some time. The progress we’re making is reflected in growth across several parts of our portfolio, the growing strength of our balance sheet, and the strong support we’re receiving from customers and channel partners. Innovation is igniting our comeback, and at a time when many of our competitors are confronting new challenges, two years of turnaround work is setting us up for an exciting future.”

Leave a Comment

Want to join the discussion?Feel free to contribute!