Hewlett Packard Securities Analyst Meeting

The new leadership teams that will care for Hewlett Packard after it splits have provided independent insights on development strategies, as well as the financial outlook for the new companies during HP’s 2015 Securities Analysts Meeting.

The new leadership teams that will care for Hewlett Packard after it splits have provided independent insights on development strategies, as well as the financial outlook for the new companies during HP’s 2015 Securities Analysts Meeting.

The company will officially split into Hewlett Packard Enterprise and HP Inc. on November 1, 2015.

Meg Whitman, the future president and CEO of Hewlett Packard Enterprise, overviewed strategies and plans to maintain the company’s leading position in infrastructure, software, services and cloud. According to Whitman, the new Hewlett Packard Enterprise will focus on delivering unrivaled integrated technology solutions to a market with the potential to exceed $1 trillion over the next three years.

Tim Stonesifer, the future Chief Financial Officer of Hewlett Packard Enterprise, provided a financial outlook for Hewlett Packard Enterprise in fiscal 2016, with key messages including:

• Estimates non-GAAP diluted net EPS for fiscal 2016 of $1.85 to $1.95 and GAAP diluted net EPS for fiscal 2016 of $0.75 to $0.85

• Estimates free cash flow of $2.0 to $2.2 billion in fiscal 2016 or normalized free cash flow of $3.7 billion before separation and restructuring cash payments

• Expects to return at least 50% of free cash flow in fiscal 2016 to shareholders through dividends and share repurchases

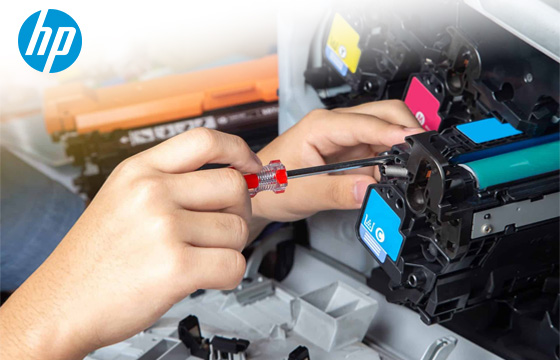

Dion Weisler, the future President and CEO of HP Inc., shared the strategy on how to maintain its leading position in printing and personal systems, as well as main factors that make the new company a compelling investment opportunity.

Cathie Lesjak, future Chief Financial Officer of HP Inc., provided the financial outlook for the new company in 2016. Lesjak claims that HP Inc. will focus on strengthening key areas, such as business printing, graphics, commercial mobility, and services, to offset challenges from the competitive pricing in printing and soft demand in PCs. In summary:

• Estimates non-GAAP diluted EPS outlook for fiscal 2016 of $1.67 to $1.77 and GAAP diluted EPS for fiscal 2016 of $1.55 to $1.65

• Estimates fiscal 2016 free cash flow of $2.5 to $2.8 billion

• Expects to return up to 75% of fiscal 2016 annual free cash flow to shareholders through dividends and share repurchases

Detailed information see: http://h30261.www3.hp.com/news-and-events/hp-investor-events/upcoming-events/09-15-2015.aspx

You’re Welcome to Contact Us!

You can provide opinions and comments on this story!

Or you can send us your own story!

Please contact Violien Wu, Head of News & Editorial, via violien.wu@iRecyclingTimes.com

Leave a Comment

Want to join the discussion?Feel free to contribute!