Another Open Letter to HP

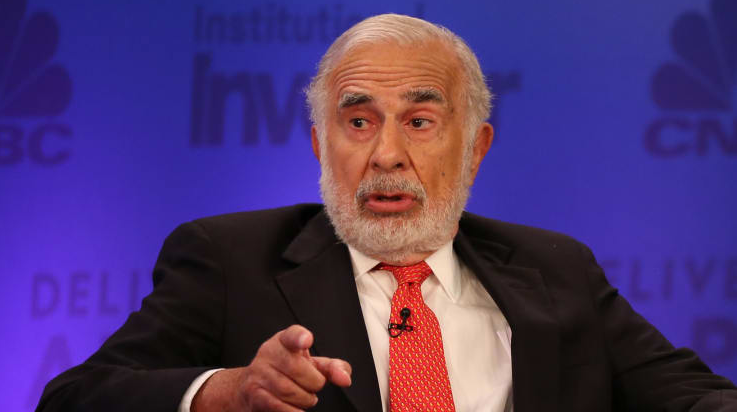

Activist investor Carl Icahn (pictured) on is chastising HP Inc.’s board for rejecting Xerox’s takeover bid.

In an open letter to HP shareholders earlier Wednesday, Icahn said: “I cannot believe that the recalcitrance of HP’s board is driven by any real confidence in its standalone restructuring plan, which the market, shareholders and analysts met with extreme indifference and which seems to amount to little more than rearranging the deck chairs on the Titanic.”

Icahn, who owns about 10.85% of outstanding shares of Xerox and 4.24% of outstanding shares of HP, urged the shareholders to appeal to the board to further explore the possibility of an acquisition by Xerox. He suggested that HP’s executives have been motivated by selfish reasons in rejecting the takeover bid.

“Because I see no other plausible explanation for HP to refuse to engage in customary mutual due diligence, I am left to wonder whether this is simply a delay tactic aimed at attempting to preserve the lucrative positions of the CEO and members of the board, which they fear might be affected if a combination does take place,” Icahn wrote.

“While this might sound cynical, over the last several decades as an activist I have made billions and billions of dollars not only for Icahn Enterprises but for all shareholders by standing up to managements and boards that have refused to do anything that would change the status quo, which might mean threatening their huge incomes. While there are many good and caring boards and managements, there also are many terrible ones that have cost shareholders dearly by failing to act in their best interests, as HP’s board and management seem to be doing now.”

HP’s board unanimously voted last month to reject Xerox’s bid, claiming the offer was not in the best interest of its shareholders and would undervalue the company. Xerox offered $22 per share for HP, which has a market cap of about $29 billion, about three times that of Xerox’s.

HP had been engaged in broad cost-cutting, planning to cut thousands of jobs to save $1 billion per year. In its rejection of Xerox’s bid, HP directors noted “the decline of Xerox’s revenue from $10.2 billion to $9.2 billion (on a trailing 12-month basis) since June 2018, which raises significant questions for us regarding the trajectory of your business and future prospects.”

Icahn had pushed for the merger after taking a $1.2 billion stake in HP. Icahn told The Wall Street Journal he felt the move would be “a no-brainer” and believed “very strongly in the synergies.”

But so far, the companies’ boards have not seen eye to eye. After HP’s rejection, Xerox has decided to go straight to shareholders with its offer after giving HP another chance to reconsider its bid.

“The potential benefits of a combination between HP and Xerox are self-evident,” Xerox CEO John Visentin wrote last week. “Together, we could create an industry leader — with enhanced scale and best-in-class offerings across a complete product portfolio — that will be positioned to invest more in innovation and generate greater returns for shareholders.”

Click here to read full letter from Carl Icahn

(Source: https://www.cnbc.com/)

Related Readings:

Xerox Issues Letter to HP, Threatens Hostile Takeover

Leave a Comment

Want to join the discussion?Feel free to contribute!