Entry-Level 3D Printer Shipments Surge on Tariff Fears

Entry-Level 3D Printer Shipments Surge on Tariff Fears

The global 3D printer market saw sharply divergent trends in the first quarter of 2025, according to the latest analysis by global market intelligence firm CONTEXT.

‘Amid looming tariff wars, unstable market conditions, persistent inflation and high interest rates, the Entry-level class saw a significant surge in shipments, while the Industrial and Midrange sectors continued to face headwinds,’ said Chris Connery, VP of global analysis at CONTEXT.

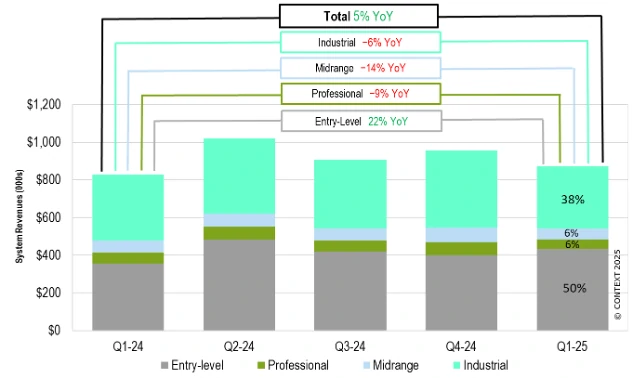

Overall system revenues grew by 5% year-on-year (YoY), due entirely to a 22% increase in revenues from entry-level printers as consumers and channel partners made purchases to get ahead of threatened tariffs. In contrast, revenues from the critical high-end Industrial segment slid by 6% as end-markets were paralysed by rapidly changing tariff policies, unstable business environments and the high cost of capital.

Three key trends defined Q1 2025:

- Entry-level shipments surged, rising 15% YoY, reversing a negative trend from the second half of 2024.

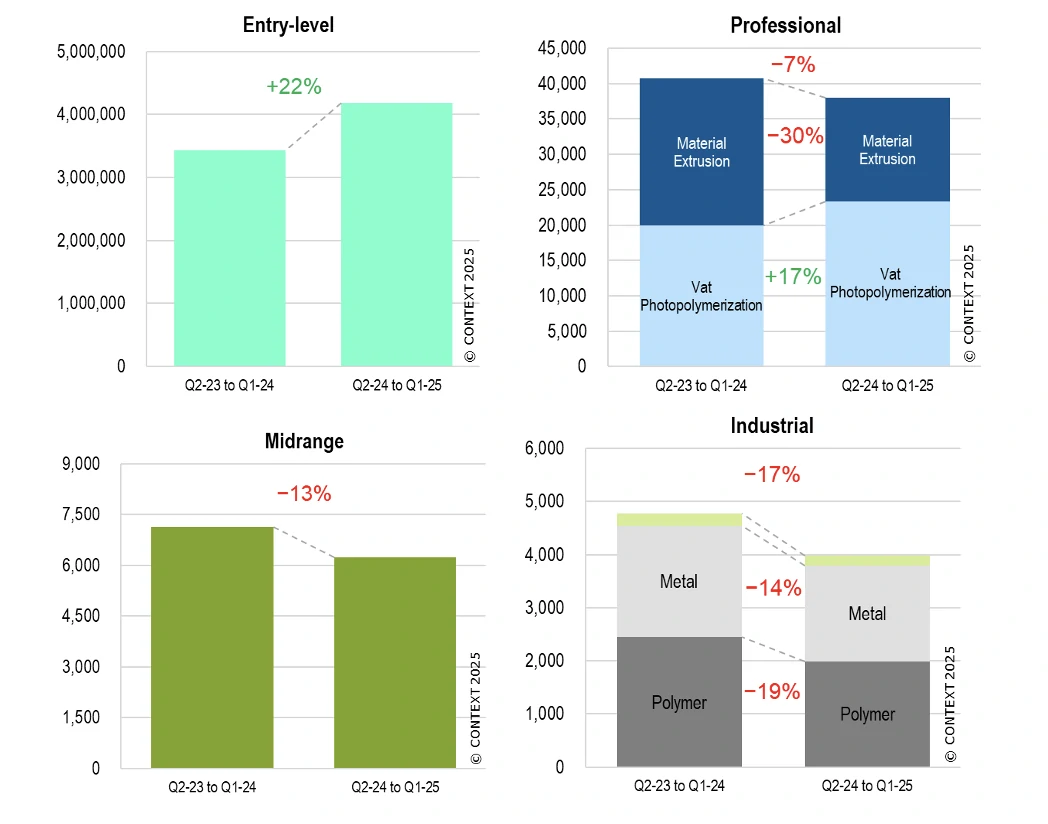

- Industrial and Midrange systems continued to struggle as high interest rates constrained capital spending. Industrial shipments were down 17% and midrange shipments 13% on a TTM basis.

- The fortunes of different technologies within the Professional price class diverged, and overall shipments saw a modest decline of 4%.

Industrial and Midrange systems

High interest rates continued to deter capital expenditure, leading to another challenging quarter for the Industrial and Midrange price classes. Global Industrial 3D printer shipments fell 14% YoY in Q1 2025, and the same negative trends were almost across the board. While Chinese companies held up better than those in the West, and metals printers did better than polymer printers, no region or technology was immune to the geopolitical and inflationary situation.

There was a similar pattern for Midrange printer shipments, which dropped 16% YoY in Q1 2025. Chinese vendors – mostly fulfilling domestic demand – fared better than Western vendors in the period. Over the trailing-twelve-month period, established Western companies such as Stratasys, 3D Systems and Formlabs saw sales fall, contributing to a 13% drop in global shipments on a TTM basis.

Professional printers

The 4% fall in shipments of Professional printers masks a significant technology shift. Material extrusion (mostly FDM/FFF) machines continued to lose momentum, with shipments dropping 31% in the period (and down 30% over the TTM) as buyers instead chose high-performance entry-level solutions from vendors like Bambu Lab.

Conversely, vat photopolymerization shipments were up 19% YoY in Q1 (and up 17% in the TTM) as vendors such as Formlabs and SprintRay revitalised the segment by introducing new products based on mSLA technology and seeing growth as a result.

Entry-level printers

The Entry-level category was the standout performer in Q1 2025, with over a million units shipped globally in the period representing a 15% YoY increase. This growth was almost entirely driven by shipment pull-in as vendors, channel partners and end-users accelerated purchases in anticipation of US tariffs on Chinese goods.

Chinese vendors accounted for 95% of all Entry-level printers shipped globally in the quarter. Bambu Lab performed best in terms of growth, with a 64% YoY increase in shipments. Meanwhile, although Creality saw a minor sales dip of 3%, it remained the dominant vendor with a 39% market share based on unit sales. Other top vendors, including Flashforge and Elegoo, also saw strong YoY growth.

While shipments remained strong for entry-level 3D Printers in early 2025, market dynamics in the first half of the year have led to downward revisions of forecasts for higher-end systems. Economic headwinds – including tariffs, inflation and high interest rates – are now expected to persist through 2025, with a significant market recovery in the high-end of the market not projected until 2026.

Related:

- EU Commission Reveals Gaps in E-Waste Directive

- 3D Printing Market Expected to Quadruple in Years

- Digital Printing Thrives in US & Western Europe

- Ink Tank Models Drive Printer Shipment Growth in Q1

- Thermal Printer Market Grows with E-commerce Trend

Comment:

Please leave your comment below about the news: Entry-Level 3D Printer Shipments Surge on Tariff Fears.

Leave a Comment

Want to join the discussion?Feel free to contribute!