The Merger of SP Richards and Essendant & What it Means for Resellers!

![]()

Originally written and published at blog.eandssolutions.com

The Merger of SP Richards and Essendant & What it Means for Resellers!

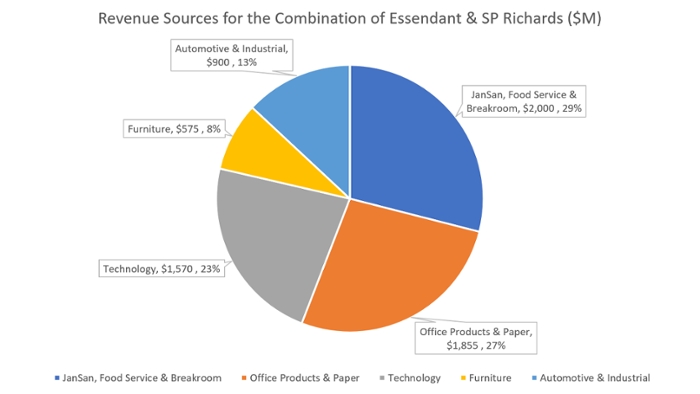

On April 12, 2018, the office products industry finally learned what many had long predicted; that Essendant and SP Richards had agreed to merge their businesses into a single entity with a combined $7 billion in annual sales. Most were probably not surprised to learn of the deal as the prospect of a combination for the past few years has been more a question of when, rather than if.

Essendant:

Three years ago, Essendant had a share price of $40 and a market capitalization of approximately $1.5 billion. This compares to $280 million at the time of writing which represents a decline of more than 80% over the three-year period. During the same time frame, sales declined 5% from $5.3 billion to $5.0 billion. However, more telling than the fairly modest decline in sales was the nearly 70% decline in EBITDA from $259 million to $85 million. This is the key indicator underpinning the 80% decline in enterprise value.

Although Essendant appears to have done a pretty good job defending its top line over the last few years, it also appears to have been at the expense of profitability.

SP Richards:

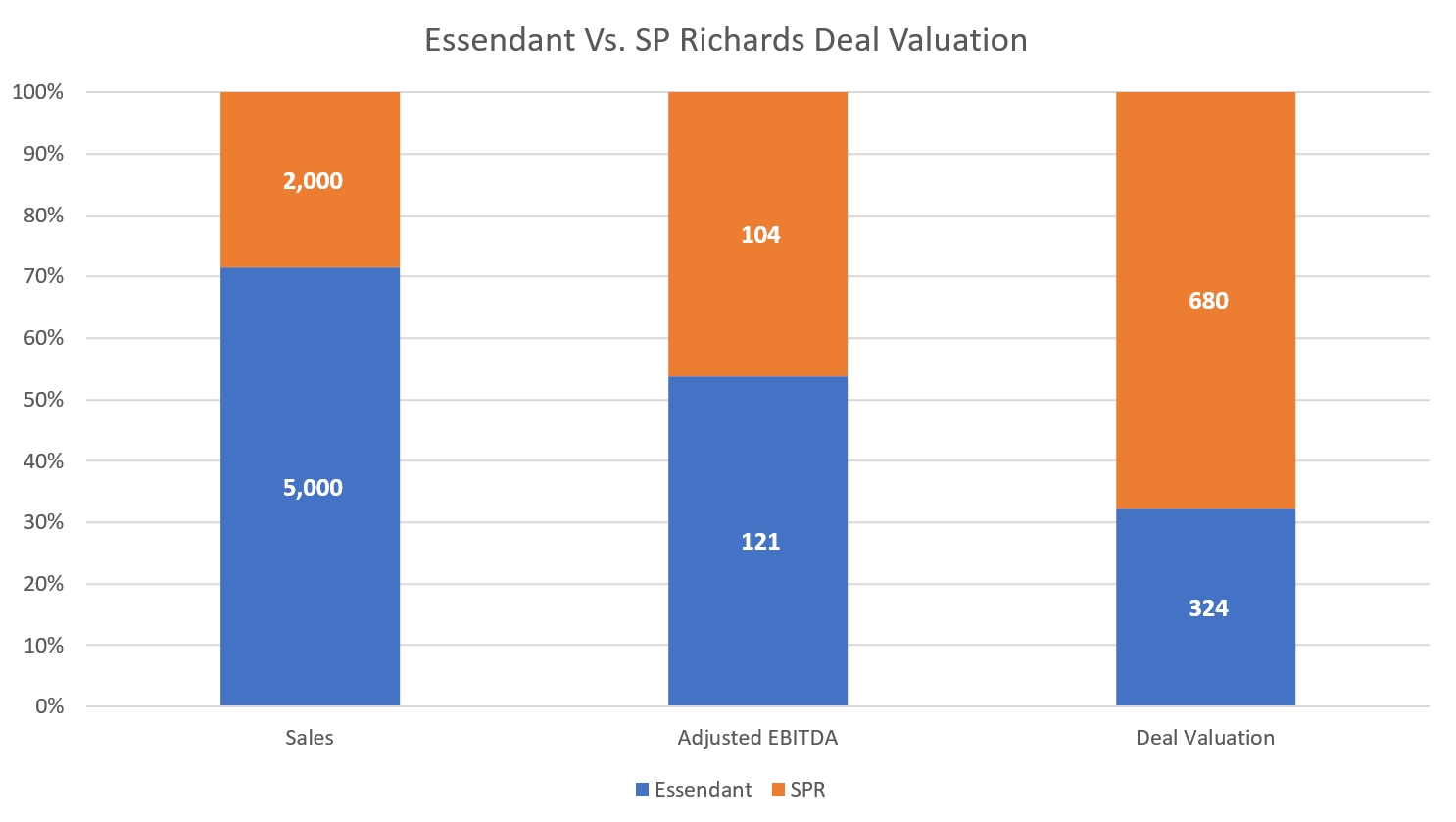

SP Richards is a division of General Parts Company, a global distributor focused primarily on auto parts with annual sales of $16 billion, and a market cap of $13 billion. The SP Richards portion of its business makes up around $2 billion (12% of GPC sales) and is only 40% the size of Essendant’s top line.

In its most recent quarterly earnings report for the quarter ending March 31st, 2018, General Parts Company disclosed the Business Products Division (SP Richards) had experienced another 5% decrease in sales.

However, of particular note is that SP Richards, with only 40% of Essendant’s sales, is valued more than two times higher. Essendant’s deal value of $324 million represents around 2.7 times their adjusted 2017 EBITDA of $120 million, whereas SP Richard’s valuation of $680 million is around 6.8 times what we estimate to be approximately $100 million of EBITDA.

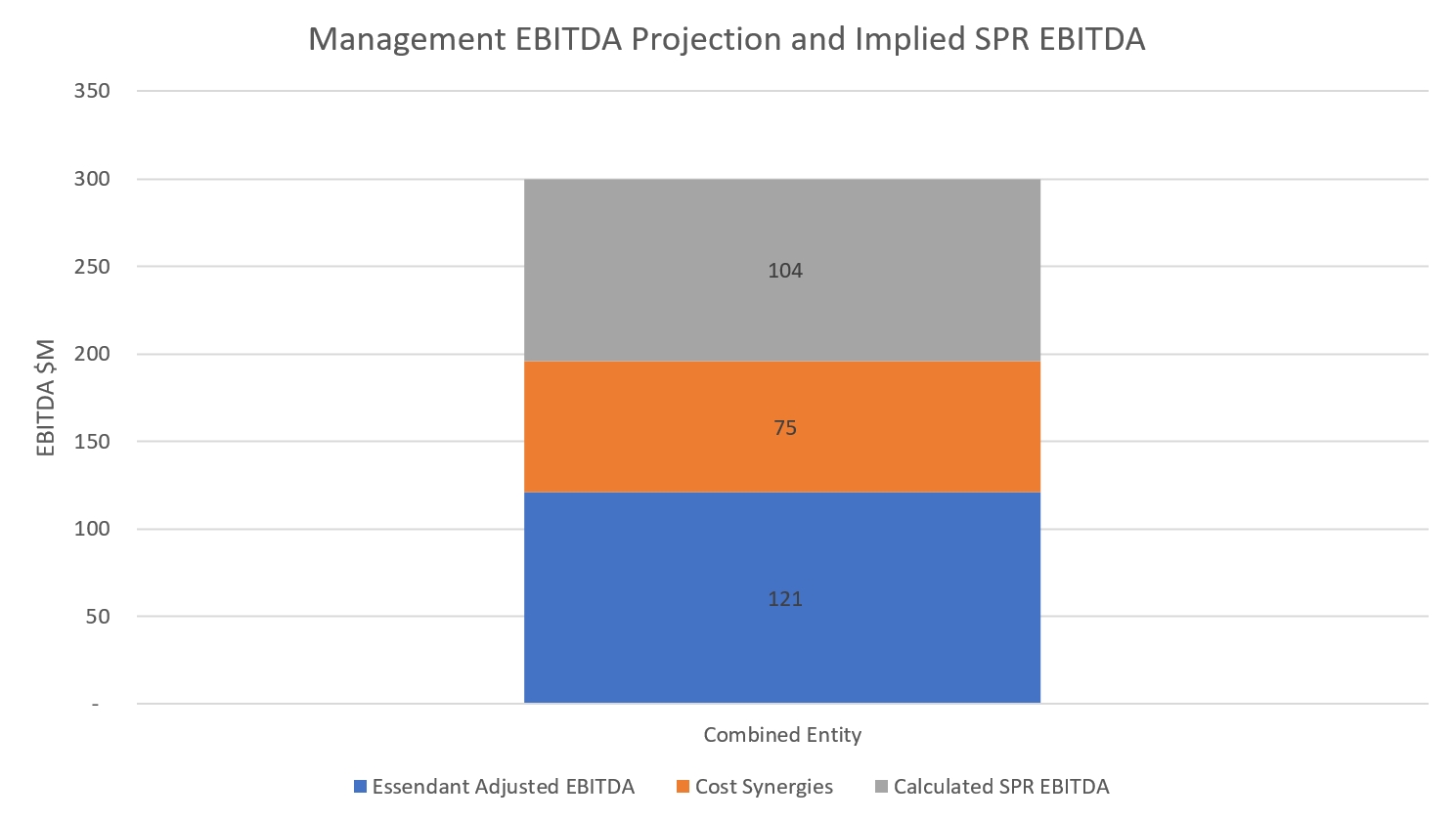

How did we estimate SP Richards EBITDA?

With a declared post-deal/post-synergies target of $300 million of EBITDA (including $75 million of expected synergies within the second year of closing), we are able to calculate SP Richard’s EBITDA to be around $100 million, or 5% of sales, versus Essendant’s Adjusted $121 million of EBITDA at 2% of sales. So, SPR has an implied valuation of 6.5 times EBITDA versus Essendant’s 2.7!

The Deal Structure

Essendant is financing the deal with a combination of debt and shares. They will pay General Parts Company $347 million at closing and issue approximately 38.5 million new shares. This will result in GPC becoming the largest shareholder with 51% ownership.

The deal will increase total debt from around $500 million to $850 million which, assuming management achieve the targeted $300 million in EBITDA, still results in a manageable debt to EBITDA ratio of around 2.8. The deal is proposed to take place via a “Reverse Morris Trust” structure and the “new” entity will remain listed on NASDAQ under the existing ESND symbol.

You can access the management presentation explaining the SP Richards deal structure from this link.

Management has identified $75 million of synergistic savings to be implemented at a cost of $50 million. It’s not difficult to believe these savings are achievable as distribution centers and sales and marketing infrastructures are consolidated. It’s also not difficult to believe there will be $100 million in working capital improvements as inventories are reduced, freeing up more than sufficient cash to finance the cost of implementing the synergies.

On the face of it, the combination of Essendant and SP Richards makes a great deal of sense.

What are the risks?

What’s more worrisome is the top line.

What could mitigate this risk?

More information please visit here.

Conclusions

There is a great need within the office products and supplies industry for a strong national wholesaler. The success of the wholesaler is in the hands of the resellers and the success of the resellers is contingent on the performance and support of the wholesaler. This common interest should motivate both sides to provide what the other needs.

SP Richards enjoys more than two-times (5.2%) the EBITDA percent that Essendant currently earns (2.4%). So, in addition to the $75 million of identified deal synergies, what can Essendant learn from SP Richards best practices in order to prevent the combined entity from sliding down to the current level of profitability earned by Essendant?

All the technology necessary to upgrade small resellers to permit them to compete more effectively with Amazon and the big-box resellers (such as Office Depot and Staples) is available. The issue is its deployment in a form that relatively technophobic resellers can adopt and then use effectively to help win market share.

The new Essendant must leverage its scale to better support its resellers. Shipping and handling fees are a constant source of concern at the reseller level and stabilization of policies and costs in this area would be likely to go a long way in supporting resellers and their growth ambitions.

Closing the deal is contingent on shareholder and regulatory approval although it’s unlikely either of these potential obstacles will prevent the transaction from taking place. The success of the deal in the future is therefore likely to be measured in terms of management’s ability to execute the cost reductions and stabilize the top line.

Leave a Comment

Want to join the discussion?Feel free to contribute!