Printer Hardware Sales Stay Flat

Originally published at: https://www.contextworld.com/

Printer hardware sales through Western European distributors stay flat in Q4 2018

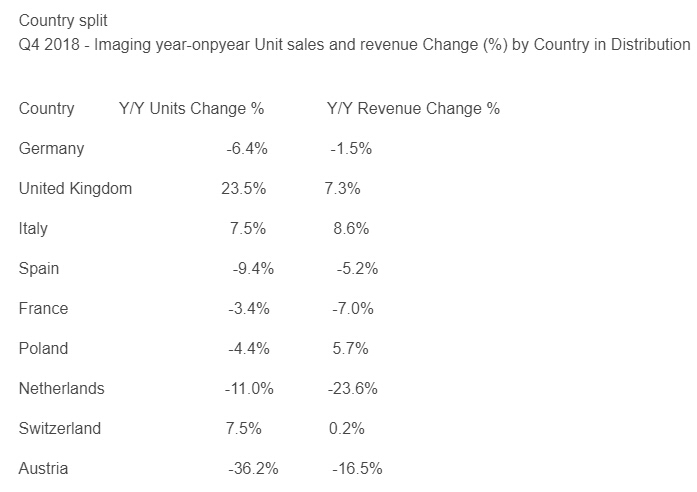

Sales of printer hardware through distributors in Western Europe (WE) were flat at -0.1% year-on-year in Q4 2018, mainly driven by the negative performance registered in December, which was a short month due to the Christmas holidays, according to the latest distribution data published by CONTEXT, the IT market intelligence company.

Sales of printer hardware through distributors in Western Europe (WE) were flat at -0.1% year-on-year in Q4 2018, mainly driven by the negative performance registered in December, which was a short month due to the Christmas holidays, according to the latest distribution data published by CONTEXT, the IT market intelligence company.

Laser devices reversed the trend seen earlier in the year by outperforming inkjet devices, and sales of consumer-targeted devices increased by +8.5%. Consumer printers steadily increased their market share and drove overall imaging growth in 2018.

Sales of multifunction printers (MFPs) were up by +2.2% year-on-year with continued growth for both laser and inkjet MFPs (sales were up by +4.1% and +1.7%, respectively). However, this was offset by the negative performance of single-function printers (SFPs) of which sales were down by -10.1% (-20.6% for inkjet SFPs and -7.2% for laser SFPs). This pattern confirms that the shift from single- to multifunction devices is continuing and is likely to be further consolidated going forward, particularly for lower spec models for which there is not a high demand from resellers, according to an UK Distributor (which has also informed that they are frequently asked if they can secure high volume, low spec, low price for export).

Sales of inkjet MFPs were better than during the same period in 2017. Monochrome and A3 MFPs were still driving inkjet growth with sales +42.2% and +13.8% higher than the previous year. Entry-level ranges (priced up to €400) continued to lead sales of consumer-targeted MFPs, accounting for 99.8% of units and generating €91 million. Sales in the higher price bands of this range also grew significantly, up by +38.8% for printers costing €150–200, +68.1% for those costing €200–300 and +40.7% for devices priced at €300–400. Sales of mid-level printers saw a double-digit increase in the €500–600 price band, which grew by +49.7% year-on-year.

Laser MFP volume sales were up by +4.1% in Q4 2018 driven by the exceptional performance of consumer-targeted devices (sales up by +111.6%), primarily because the ASP is continuing to decrease. The business-targeted models, which account for 72.1% of laser MFP sales and 89.4% of revenue, registered a sales drop of -13.2%, mainly because the ASP is continuing to increase, and which suggests businesses are replacing entry-level business-targeted models with mid and high-level consumer-targeted devices.

2018 saw the print industry continue to face the stark realities of digital disruption, however, sales of multifunction printers (MFPs) were up by +1.2% year-on-year in 2018 with continued growth for both laser and inkjet MFPs in 2018 (sales were up by +3% and +0.9%, respectively), which does not show a noticeable shift in sales towards the Managed Print Services (MPS).

“According to the distribution channel, more and more resellers are looking at complimenting their offering by having an MPS proposition (partnering with vendors directly or indirectly, or through MPS dealers to support their business)”, said Antonio Talia, Head of Business Analysts at CONTEXT.

“However, vendors still need to expand their security assessment and monitoring services, along with partnering with traditional IT security providers, particularly in the area of threat intelligence to ensure that print security is treated with the same priority as the rest of the IT infrastructure. Print and digital convergence will drive increased demand for integrated document workflow in 2019, and despite the rapid adoption of digital and mobile technologies, many businesses remain reliant on print to some extent.”

Leave a Comment

Want to join the discussion?Feel free to contribute!