IDC: Ink Tank Printers Outperform in Indonesia

Originally written and published at idc.com

IDC Indonesia: Hardcopy Peripherals Market Remains Flat but Ink Tank Printers Outperform in 2017

The Hardcopy Peripherals (HCP) market in Indonesia had a total shipment around 2 million units in 2017, a 0.6% year-over-year (YoY) growth, according to IDC Asia/Pacific Quarterly Hardcopy Peripherals Tracker, 2017 Q4. Overall consumer and business sentiments were stable, and the inkjet market witnessed just 0.3% YoY growth with shipments reaching 1,8 million units in total. This growth was primarily driven by the ink tank printers, which recorded a high YoY growth of 17.5%. Ink tank printers continued to make inroads in the office and commercial segments. Meanwhile, the laser printer market, including copiers, registered a total shipment around 180,000 units with 8.1% YoY growth.

Indonesia HCP market highlights:

Inkjet remained the dominant technology in the HCP market in Indonesia, driven by ink tank printers and ink tank contribution going beyond 45.0%. Ink tank printers have been growing constantly since 2014 at a CAGR of 32.7% while ink cartridges have been dropping at a CAGR of 17.0%. Ink tank printers are successfully penetrating the market by offering low cost, high printing volume, and low maintenance. Meanwhile for laser, single-function laser printers — especially low-end single-function printers as Indonesia is still a price-sensitive market — still contribute to most of the laser segment’s growth. Laser copier–based MFP market shipment reached around 17,000 units in 2017, dominated by the monochrome laser segment. Growth in the laser copier–based MFP market was driven by greater demand from the government due to the presidential election in 2019. SDM (dot-matrix) printers continued to drop in 2017 as users are gradually migrating to laser/inkjet printers.

Top 3 vendor highlights:

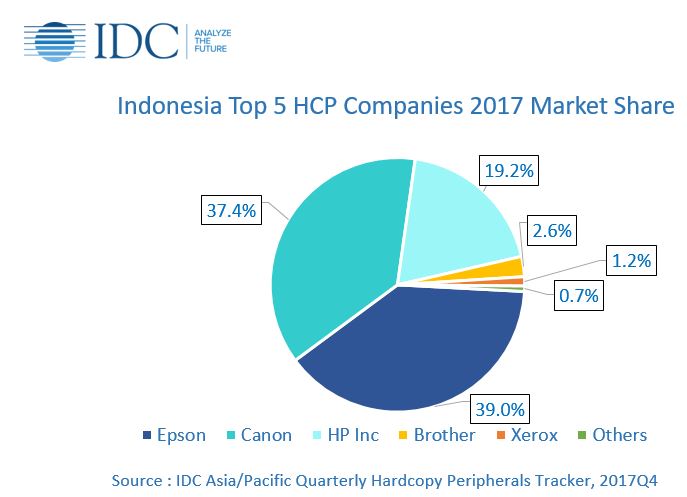

Epson topped the HCP market with a share of 39.0% and a YoY growth of 20.4%. Epson has a strong brand image for its ink tank printers; its messaging of being a pioneer in the ink tank printer market has supported this growth.

Canon suffered a YoY drop of 14.0%, pushing it to second place in the HCP market for 2017 with 37.4% market share. Canon’s performance dropped in both ink tanks (by 43% YoY) and ink cartridges (by 12.1% YoY) but recorded significant growth in the laser segment by 49.3% YoY.

HP Inc remained third with a share of 19.2%. The inkjet segment still dominated HP shipment across all its HCP products, but interestingly shipment growth mostly came from HP laser printers, especially the low-end single-function laser printer. Shipment of the low-end single-function laser printer recovered from 2016 figures because of high demand in the retail market, especially the SMB segment.

You can learn more about IDC by visiting www.idc.com

Leave a Comment

Want to join the discussion?Feel free to contribute!