Brother Reports Decline in Q1

Brother Reports Decline in Q1

Like other OEMs impacted by the COVID-19, Brother reports decline in the first quarter of the fiscal year ending March 31, 2021.

Like other OEMs impacted by the COVID-19, Brother reports decline in the first quarter of the fiscal year ending March 31, 2021.

Some highlights include:

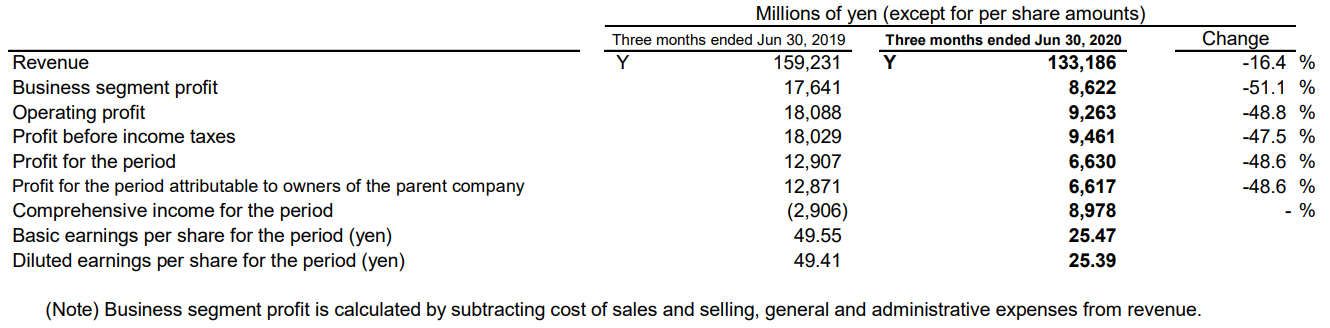

- Revenue was of 133,186 million yen (US$1.26 billion), down 16.4% comparing with the same period in 2019

- Business segment profit declined 51.1% to 8,622 million yen (US$81.59 million)

- Operating profit dropped 48.8% to 9,263 million yen (US$87.66 million)

- Profit before income taxes decreased by 47.5% to 9,461 million yen (US$89.52 million)

- Profit for the period was 6,630 million yen (US$62.73 million), down 48.6%

By segment, printing & Solutions revenue was US$767.769 million in the period, with an operating profit of US$93.444 million.

The consolidated results forecast for the fiscal year was undetermined as calculating the effects of the spread of COVID-19 reasonably had been difficult. Instead, the company calculated the results forecast on information and forecasts that are available at this time.

Regarding the impact of COVID-19, it is impossible to predict how it will spread and when it will end. GDP growth rates are expected to be negative worldwide due to the pandemic. the company claims there is growing uncertainty over the Group’s future business activities.

The Group has made estimates and judgements involving estimations that the current situation will affect its consolidated financial performance for the year ending March 31, 2021 and the situation will be serious, especially, in the first half of the year. The Group’s consolidated financial statements for the year ending March 31, 2021 and onwards (particularly, impairment losses of property, plant and equipment, right-of-use assets, intangible assets, including goodwill, and investment property) may be significantly affected depending on the actual outcome.

Related:

Comment:

Please add your comments about this story, “Brother Reports Decline in Q1”, below.

Leave a Comment

Want to join the discussion?Feel free to contribute!