3D Printing Receives Tax Credits

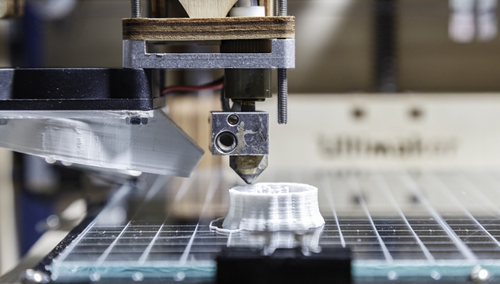

Universities throughout the USA are creating 3D printing incubators and developing 3D printing businesses thanks to a state and federal incentives that provide tax credits.

Universities throughout the USA are creating 3D printing incubators and developing 3D printing businesses thanks to a state and federal incentives that provide tax credits.

Research & development tax credits will be provided for new or improved products, processes, or software that are technological in nature and involve the process of experimentation.

Universities can earn credits for employee wages, cost of supplies, cost of testing, contract research expenses, and costs associated with developing a patent.

President Obama signed the bill making the R&D Tax Credit permanent back on December 18, 2015. However the R&D credit, to be used to offset tax payroll taxes only commenced from the beginning of 2016.

Among the 34 Universities that have fully swung in behind the initiative to provide 3D printing incubators, Youngstown State University has already developed a reputation as a leader in the 3D incubator race. It has been working to facilitate innovation through collaborative partnerships with large companies in the 3D printing industry.

Other schools such as the Florida Institute of Technology have developed a 3D printing incubators to encourage the interaction between highly innovative engineering students and business students. Entrepreneurial students across the FSU campus are able to utilize rent-free office space to run their start-up business ventures, supported by the developments in 3D printing.

Leave a Comment

Want to join the discussion?Feel free to contribute!